The Bitcoin blockchain—not to be confused with the bitcoin cryptocurrency—involves a vast global network of computers operating on the same distributed database to process massive volumes of data every second. These transactions tell the network how to alter this distributed database in real-time, which makes it crucial for everyone to agree on how these changes should be applied. When the community can’t come to a mutual agreement on what changes, or when such rule changes should take effect, it results in a blockchain fork. Today’s unique subway-style map by Bitcoin Magazine shows the dramatic and major forks that have occurred for Bitcoin. But what exactly is a Blockchain fork?

Types of Blockchain Forks

Forks are common practice in the software industry and happen for one of two reasons:

Split consensus within the community These forks are generally disregarded by the community because they are temporary, except in extreme cases. The longer of the two chains is used to continue building the blockchain. Changes to the underlying rules of the blockchain A permanent fork which requires an upgrade to the current software in order to continue participating in the network.

There are four major types of forks that can occur:

1. Soft Forks

Soft forks are like gradual software upgrades—bug fixes, security checks, and new features—for those that upgrade right away. These forks are “backwards compatible” with the older software; users who haven’t upgraded still have access to the network but may not be able to use all functionality in the current version.

2. Hard Forks

Hard forks are like a new OS release—upgrading is mandatory to continue using the software. Because of this, hard forks aren’t compatible with older versions of the network. Hard forks are a permanent division of the blockchain. As long as enough people support both chains, however, they will both continue to exist. The three types of hard forks are:

Planned Scheduled upgrades to the network, giving users a chance to prepare. These forks typically involve abandoning the old chain. Contentious Caused by disagreements in the community, forming a new chain. This usually involves major changes to the code. Spin-off Coins Changes to Bitcoin’s code that create new coins. Litecoin is an example of this—key changes included reducing mining time from 10 minutes to 2.5 minutes, and increasing the coin supply from 21 million to 84 million.

3. Codebase Forks

Codebase forks copy the Bitcoin code, allowing developers to make minor tweaks without having to develop the entire blockchain code from scratch. Codebase forks can create a new cryptocurrency or cause unintentional blockchain forks.

4. Blockchain Forks

Blockchain forks involve branching or splitting a blockchain’s whole transaction history. Outcomes range from “orphan” blocks to new cryptocurrencies. Splitting off the Bitcoin network to form a new currency is much like a religious schism—while most of the characteristics and history are preserved, a fork causes the new network to develop a distinct identity.

Summarizing Major Bitcoin Forks

Descriptions of major forks that have occurred in the Bitcoin blockchain:

Bitcoin / Bitcoin Core The first iteration of Bitcoin was launched by Satoshi Nakamoto in 2009. Future generations of Bitcoin (aka Bitcoin 0.1.0) were renamed Bitcoin Core, or Bitcore, as other blockchains and codebases formed. BTC1 A codebase fork of Bitcoin. Developers released a hard fork protocol called Segwit2x, with the intention of having all Bitcoin users eventually migrate to the Segwit2x protocol. However, it failed to gain traction and is now considered defunct. Bitcoin ABC Also a codebase fork of Bitcoin, Bitcoin ABC was intentionally designed to be incompatible with all Bitcoin iterations at some point. ABC branched off to form Bitcoin Cash in 2017. Bitcoin Gold, Bitcoin Diamond, Other Fork Coins After the successful yet contentious launch of Bitcoin Cash, other fork coins began to emerge. Unlike the disagreement surrounding Bitcoin Cash, most were simply regarded as a way to create new coins.

Some of the above forks were largely driven by ideology (BTC1), some because of mixed consensus on which direction to take a hard fork (Bitcoin ABC), while others were mainly profit-driven (Bitcoin Clashic)—or a mix of all three.

Where’s the Next Fork in the Road?

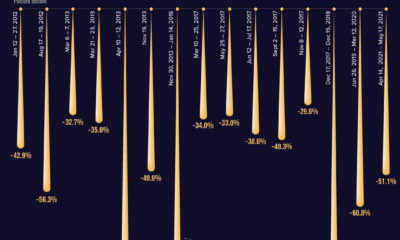

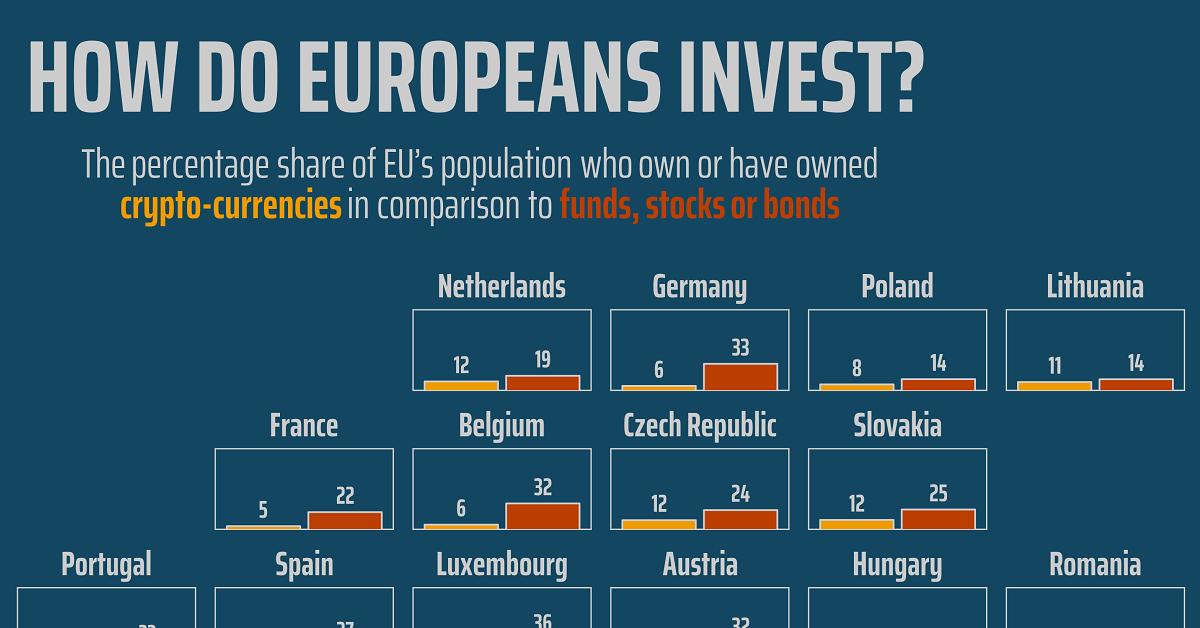

Forks are considered an inevitability in the blockchain community. Many believe that forks help ensure that everyone involved—developers, miners, and investors—all have a say when disagreements occur. Bitcoin has seen its fair share of ups and downs. Crypto investors should be aware that Bitcoin, as both a protocol and a currency, is complex and always evolving. Even among experts, there is disagreement on what constitutes a soft or hard fork, and how certain geopolitical events have played a role in Bitcoin’s evolution. on For a modern example, we can see how different countries (and regions) act when it comes to cryptocurrency. Within the European Union—one of the regions dealing with faster crypto adoption—attitudes towards investing can vary considerably. This graphic from Gilbert Fontana looks at crypto popularity amongst investors in the EU using data from the European Commission’s Eurobarometer. It compares exposure to cryptocurrencies relative to stocks, funds, and bonds.

Crypto Popularity in Europe in 2022

Given that crypto has experienced bubble-like asset rallies, including a dramatic rise to over a trillion dollars in value before crashing, it’s fair to say it’s well known by now. But even with a vast rise in awareness, there are still discrepancies between the level of investment crypto receives amongst European Union nations. Let’s see which countries have the highest proportion of citizens invested in crypto: Topping the list is Slovenia, considered by some the most crypto-friendly nation in the world. According to the survey, 18% of the country’s population has some sort of investment in it. Cyprus also ranks high in its crypto-friendly rank and hits an investment figure of 13%. Also notable is the Grand Duchy of Luxembourg, which despite having a small population of 640,000 also has a strong reputation as a global financial hub. When it comes to crypto, 14% of the population owns or has owned the asset, relative to 36% for stocks, bonds, or funds.

Crypto Unpopularity?

In regards to the countries with lower levels of crypto investment, one observation is that they tend to be wealthier and more developed EU nations. Here’s how the nations at or below the 10% crypto-investment threshold rank: At the “bottom” of crypto interest are France, Germany and Italy, also the EU’s largest economies. At a glance, this might suggest that citizens of stronger economies invest less in crypto. However, it’s important to note that the countries with higher levels of crypto investment tend to have lower levels of wealth on average. Though less of their investors seem to engage in crypto trading, countries like France and Germany might have more comparable levels of crypto investment on a pure dollar-basis.