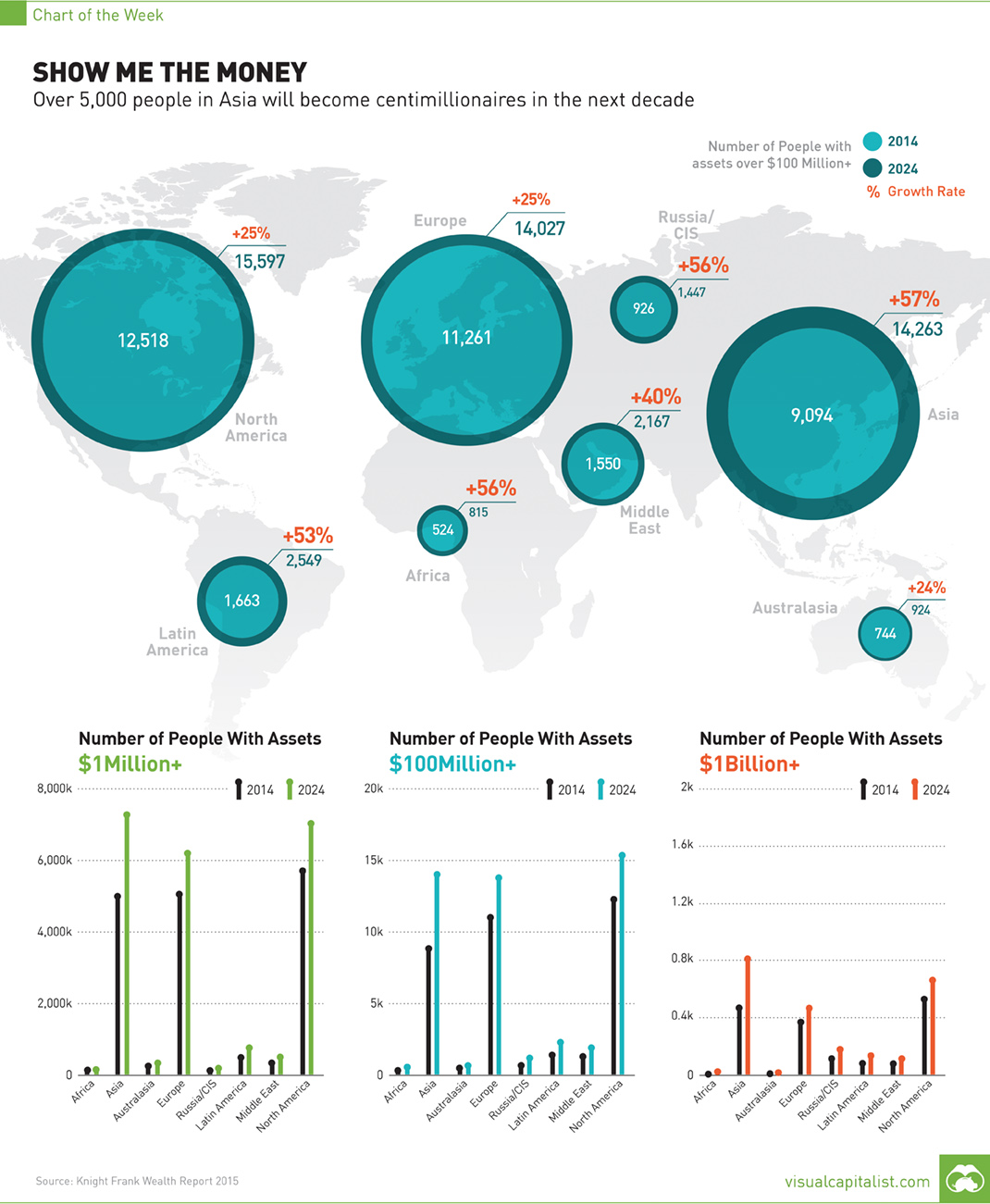

Asia to Add 5,000 New Centimillionaires Over Next Decade [Chart]

The Chart of the Week is a weekly Visual Capitalist feature on Fridays. Where in the world should a speculator go to make it big? Back in the old days, the plan was to follow the gold rushes. Your travels may have taken you to California, Colorado, or maybe even the Klondike. Today, the places to go are arguably the emerging markets, or as we recently detailed: the “emerging” emerging markets. Doug Casey, the famous speculator and best-selling author, is a fan of this strategy. He has routinely said that if he were a young man, he’d look at going to Africa rather than going to college. The data reinforces this notion. In today’s chart, we summarize some of the findings of Knight Frank’s Wealth Report 2015, which looks at how many millionaires, centimillionaires, and billionaires will be made in different regions over the next decade. All of this is based on how many assets are accumulated by an individual. To be counted as a centimillionaire, one would need over $100 million in assets. In our mind, there are three major takeaways from today’s chart: First, the growth rate for these elite groups of wealthy people are the lowest in Western countries. For example, regions like North America, Europe, and Australasia will all add new centimillionaires to their ranks at about a 25% clip over the next decade. In these areas, most of the big opportunities have been taken advantage of, and the economic growth rates of advanced economies are lower. Next, Asia leads in every category in absolute terms for adding new millionaires, centimillionaires, and billionaires. The region is projected to add 342 new billionaires at a 70% growth rate over the next decade, which is more than North America, Europe, Australasia, and Latin America combined. Also astounding is the fact that there will be 5,169 individuals that accumulate over $100 million in assets in Asia over the next 10 years. In contrast, North America will add 3,079 at less than half of the growth rate (25%). Lastly, while the absolute numbers of Asia are stunning in sheer size, it is the relative numbers that in Africa that also catch our eye. Africa will add millionaires at the highest clip of all regions in the next decade at a 53% growth rate. This speaks more to Doug’s point, which is that Africa’s growth is just beginning. For those that are willing to take the risk and get in on the ground floor, it could pay off.

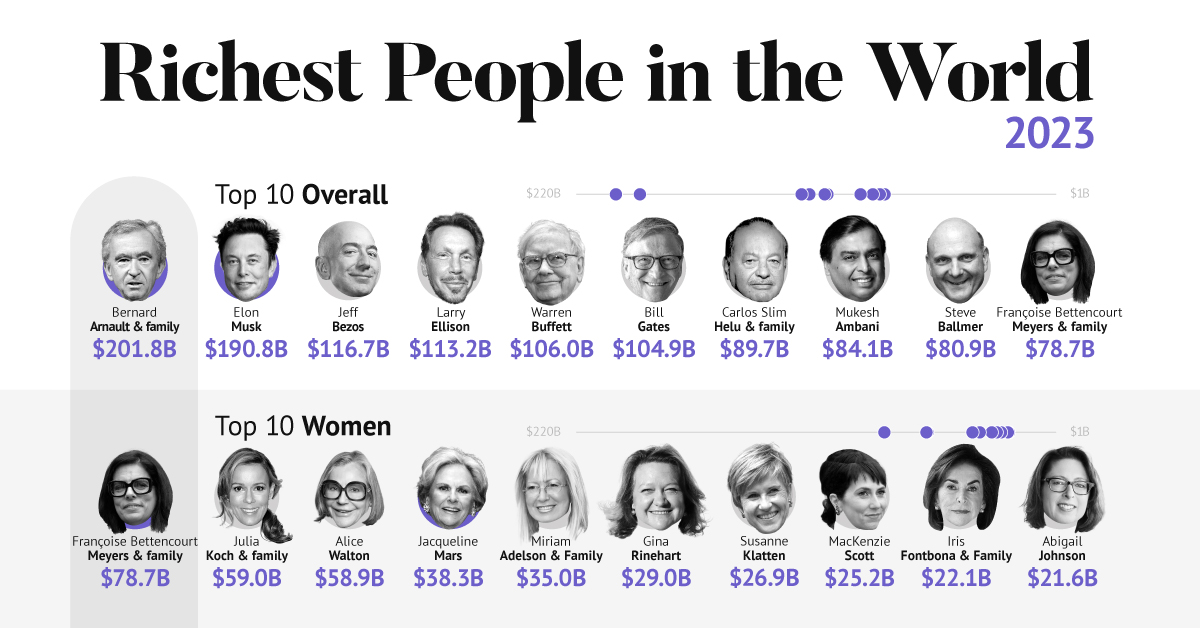

on A lagging stock market dented these fortunes against high interest rates, energy shocks, and economic uncertainty. But some of the world’s billionaires have flourished in this environment, posting sky-high revenues in spite of inflationary pressures. With data from Forbes Real-Time Billionaires List, we feature a snapshot of the richest people in the world in 2023.

Luxury Mogul Takes Top Spot

The world’s richest person is France’s Bernard Arnault, the chief executive of LVMH.

With 75 brands, the luxury conglomerate owns Louis Vuitton, Christian Dior, and Tiffany. LVMH traces back to 1985, when Arnault cut his first major deal with the company by acquiring Christian Dior, a firm that was struggling with bankruptcy.

Fast-forward to today, and the company is seeing record profits despite challenging market conditions. Louis Vuitton, for instance, has doubled its sales in four years.

In the table below, we show the world’s 10 richest people with data as of February 27, 2023:

Elon Musk, the second-wealthiest person in the world has a net worth of $191 billion. In October, Musk took over Twitter in a $44 billion dollar deal, which has drawn criticism from investors. Many say it’s a distraction from Musk’s work with Tesla.

While Tesla shares have rebounded—after falling roughly 70% in 2022—Musk’s wealth still sits about 13% lower than in March of last year.

Third on the list is Jeff Bezos, followed by Larry Ellison. The latter of the two, who founded Oracle, owns 98% of the Hawaiian island of Lanai which he bought in 2012 for $300 million.

Fifth on the list is Warren Buffett. In his annual letter to shareholders, he discussed how Berkshire Hathaway reported record operating profits despite economic headwinds. The company outperformed the S&P 500 Index by about 22% in 2022.

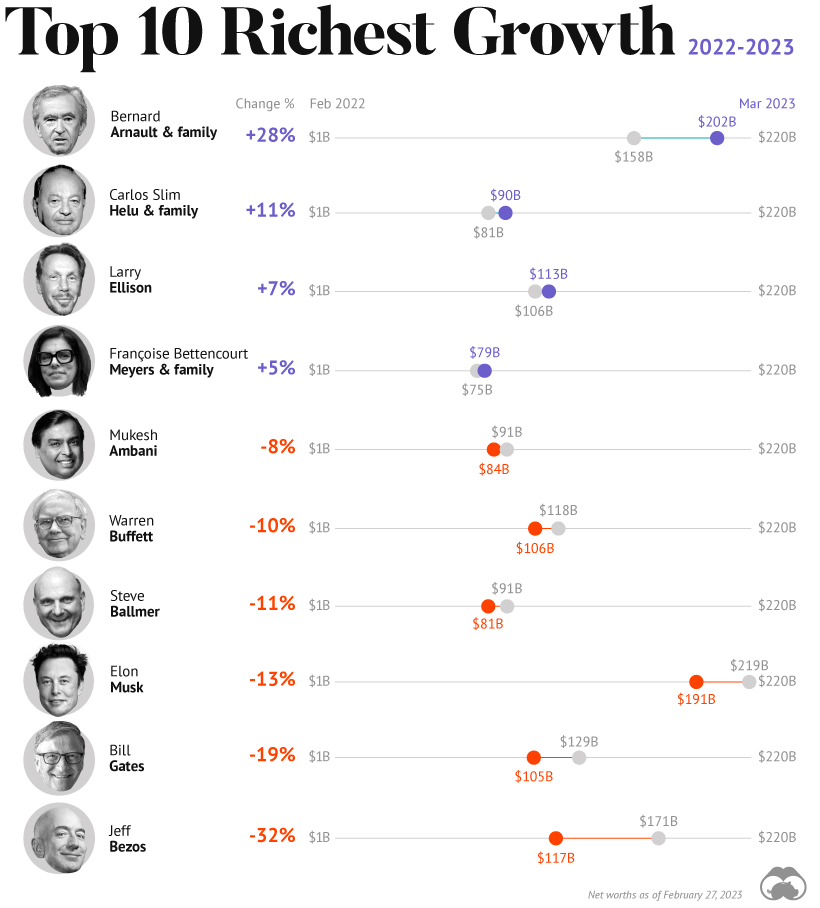

How Fortunes Have Changed

Given multiple economic crosscurrents, billionaire wealth has diverged over the last year. Since March 2022, just four of the top 10 richest in the world have seen their wealth increase. Two of these are European magnates, while Carlos Slim Helu runs the largest telecom firm in Latin America. In fact, a decade ago Slim was the richest person on the planet. Overall, as the tech sector saw dismal returns over the year, the top 10 tech billionaires lost almost $500 billion in combined wealth.

Recent Shakeups in Asia

Perhaps the most striking news for the world’s richest centers around Gautam Adani, formerly the richest person in Asia. In January, Hindenburg Research, a short-selling firm, released a report claiming that the Adani Group engaged in stock manipulation and fraud. Specifically, the alleged the firm used offshore accounts to launder money, artificially boost share prices, and hide losses. The Adani Group, which owns India’s largest ports—along with ports in Australia, Sri Lanka, and Israel—lost $100 billion in value in the span of a few weeks. Interestingly, very few Indian mutual funds hold significant shares in Adani Group, signaling a lack of confidence across India’s market, which was also cited in Hindenburg’s report. As a result, Mukesh Ambani has climbed to Asia’s top spot, controlling a $84 billion empire that spans from oil and gas and renewable energy to telecom. His conglomerate, Reliance Industries is the largest company by market cap in India.