Fintech is in the Eye of the Beholder

Finance professionals have very different perspectives

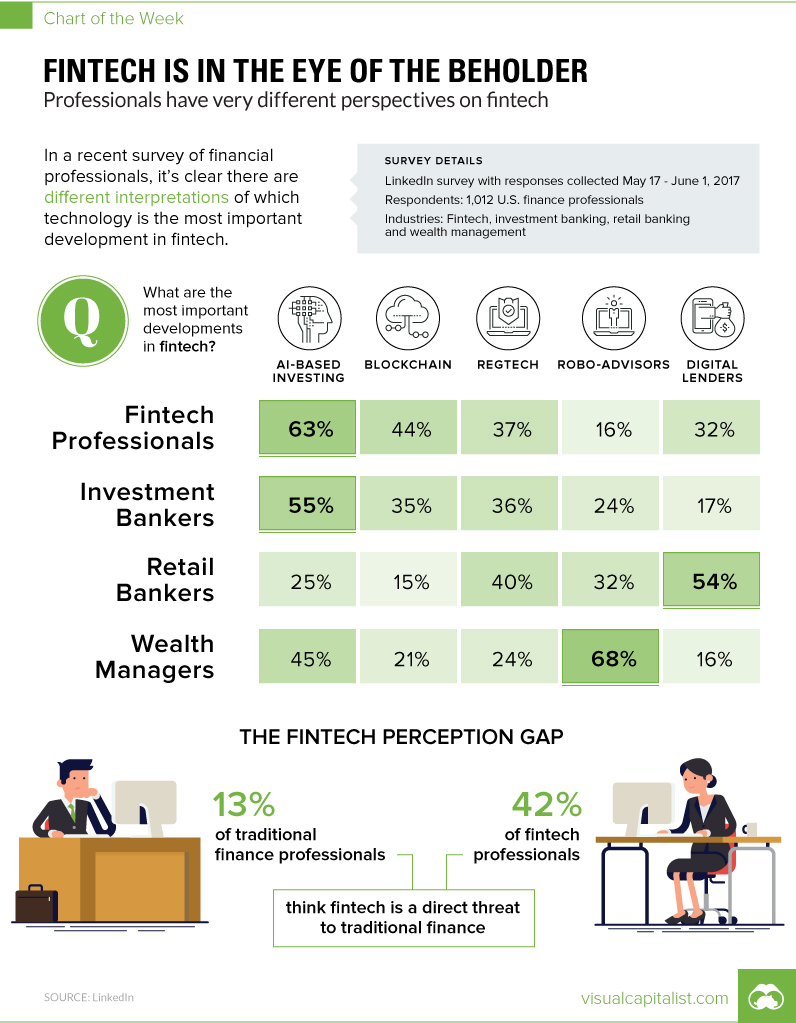

The Chart of the Week is a weekly Visual Capitalist feature on Fridays. The development of new technology in the financial sector is happening at a breakneck speed. Between the emergence of the blockchain, AI, robo-advisors, regtech, payment and loan services, and many other examples of technological progress, there are many ideas to keep track of at once. It would appear that these changes are happening so fast, in fact, that people don’t even have a uniform idea of what fintech really is.

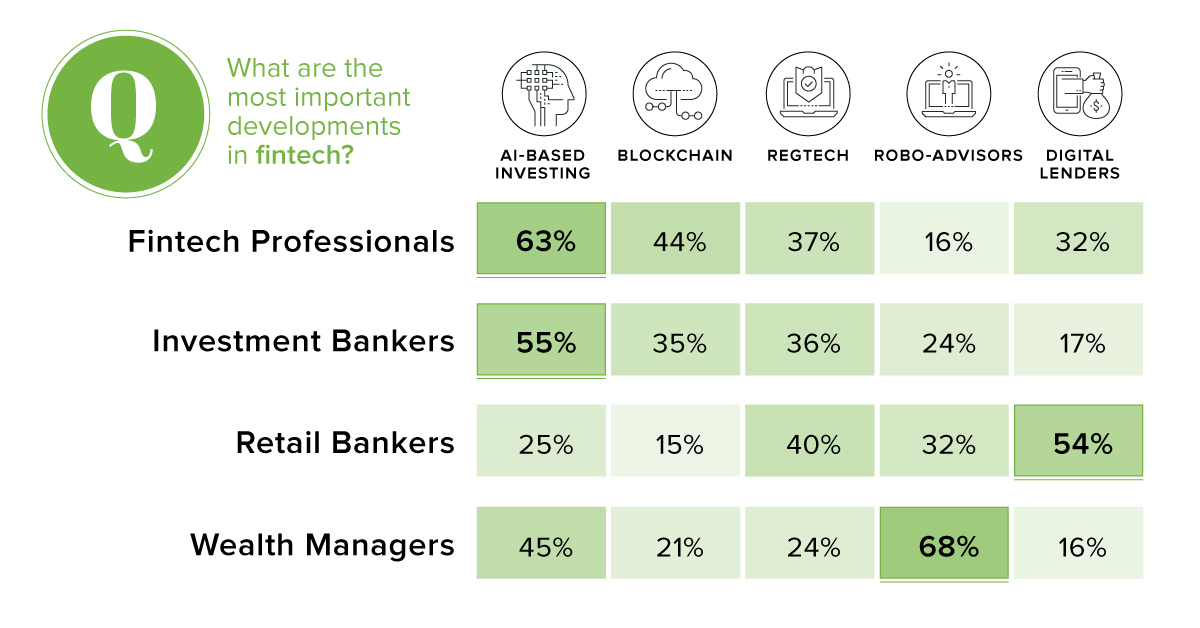

Varying Interpretations

According to the results of LinkedIn’s survey of financial services professionals, how fintech is perceived greatly depends on a person’s role within the financial industry. Wealth managers, for example, are very much aware of the robo-advisor arms race happening now, and how it may impact their future business especially with millennials. As a result, it’s likely no surprise that 68% of wealth managers rank robo-advisors as an important development within the fintech sector. Meanwhile, other developments like the blockchain (21%), regtech (24%) and digital lending (16%) are perceived as less important by this group. For investment bankers and fintech professionals, the tables are turned. Interestingly, these two groups seem to see more eye-to-eye regarding the technologies at play in the finance sector. Both fintech professionals (63%) and investment bankers (55%) saw AI-based investing as an important development, and both saw the blockchain (44% and 35%) as a key development as well.

Blockchain, Schmlockchain

Retail bankers had a very different perspective on the blockchain. They ranked both insurtech and chatbots (which we didn’t even show in our chart) as more important than the new distributed ledger technology, putting it in last place out of the options given. This could be an oversight, considering that cryptocurrencies alone are already worth more than $80 billion, and that doesn’t even include the many other potential applications of the blockchain. Retail bankers had other contrarian opinions as well – they were the only subgroup where the majority chose digital lending (54%) as the most important development in the industry as a whole.

Living in Alternate Realities?

While the jury is still out on what aspect of fintech will have the biggest impact on financial services overall, there is an even deeper question at hand: will fintech make a real impact on traditional financial services at all? It’s a question that’s very divisive, with very different answers depending on your side of the spectrum:

42% of fintech professionals see fintech as being a direct threat to traditional finance 13% of traditional finance professionals see fintech as being a direct threat to traditional finance

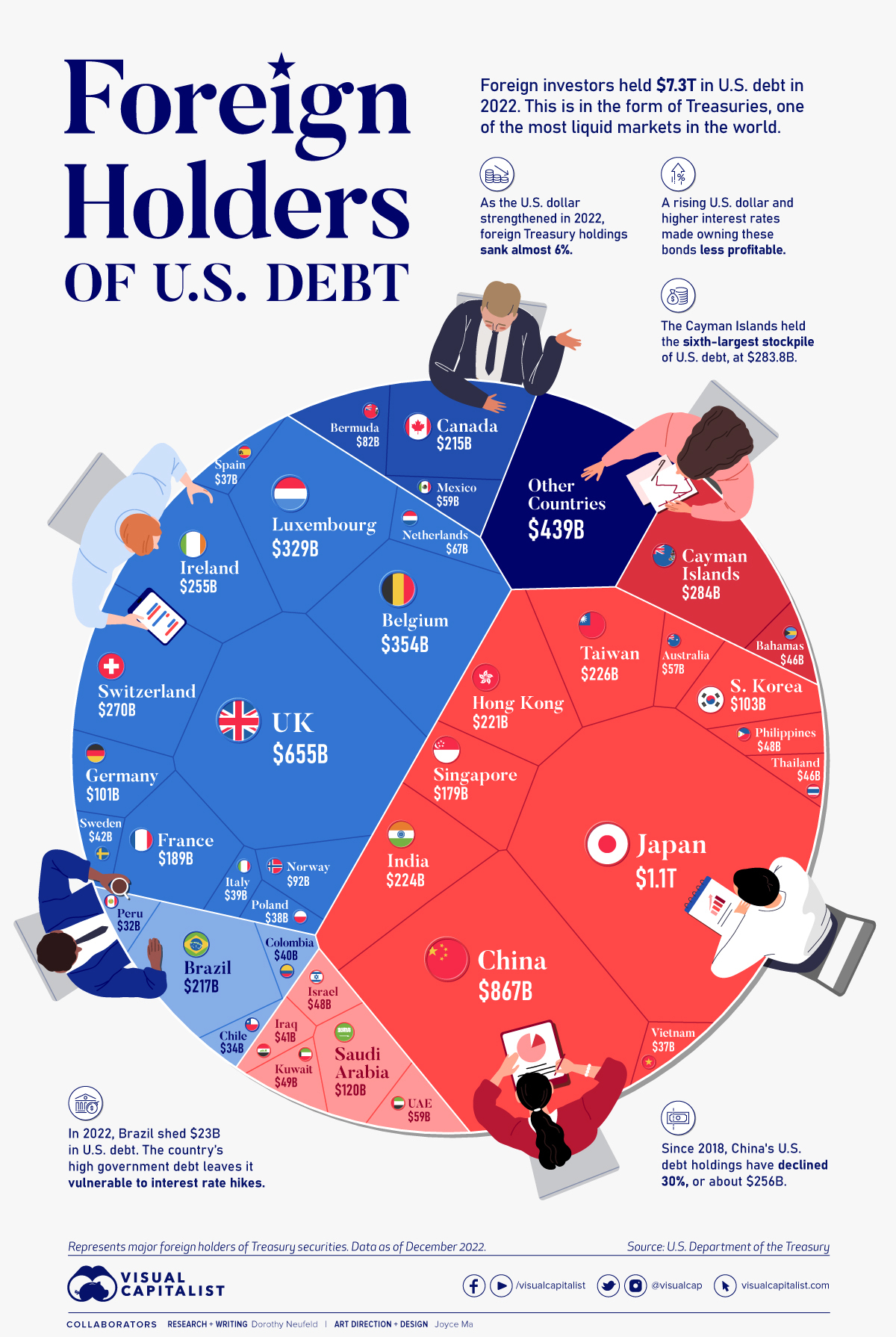

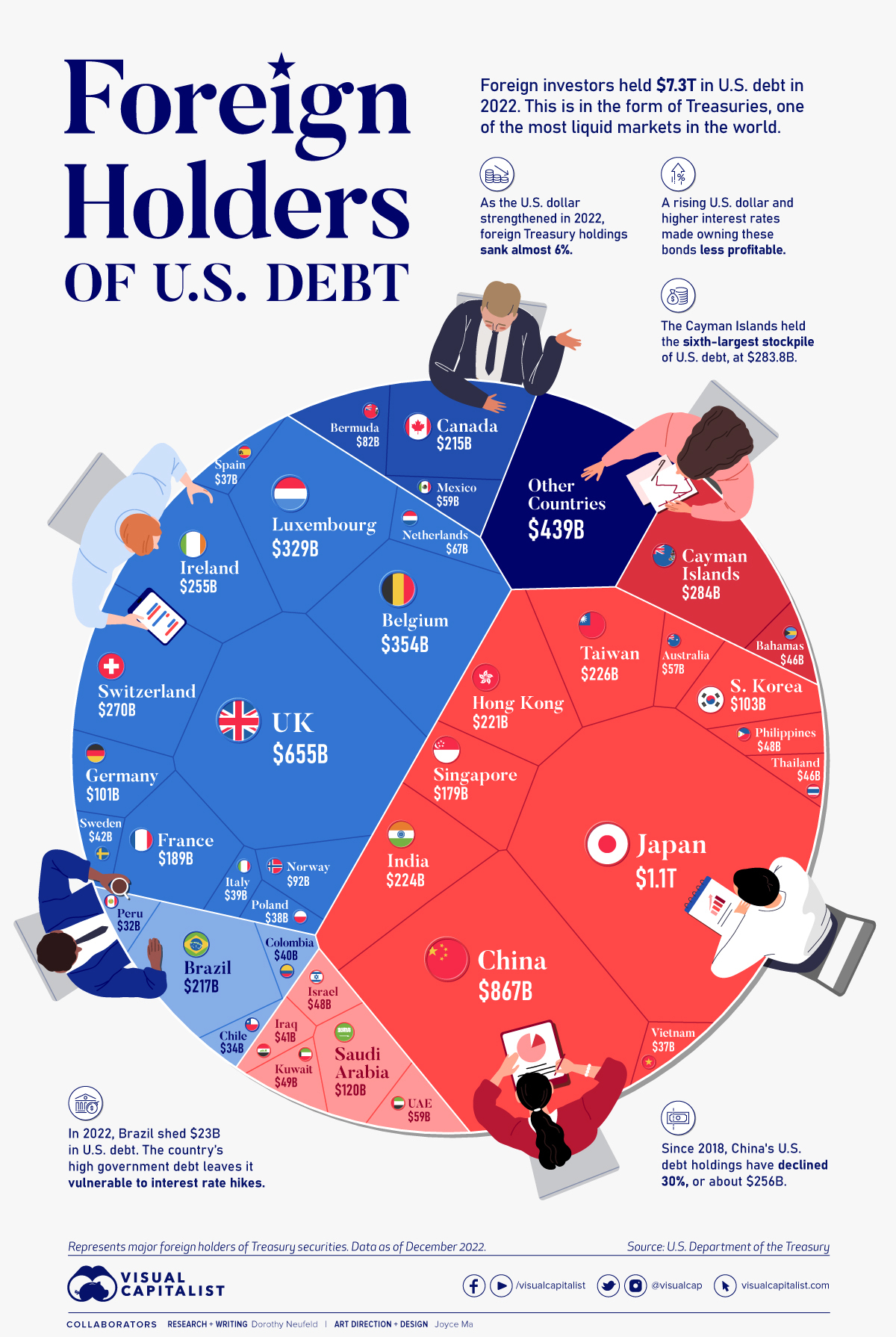

Who’s right, and who’s wrong? Surely, at least one group is going to end up disappointed with their lack of foresight. on These are in the form of Treasury securities, some of the most liquid assets worldwide. Central banks use them for foreign exchange reserves and private investors flock to them during flights to safety thanks to their perceived low default risk. Beyond these reasons, foreign investors may buy Treasuries as a store of value. They are often used as collateral during certain international trade transactions, or countries can use them to help manage exchange rate policy. For example, countries may buy Treasuries to protect their currency’s exchange rate from speculation. In the above graphic, we show the foreign holders of the U.S. national debt using data from the U.S. Department of the Treasury.

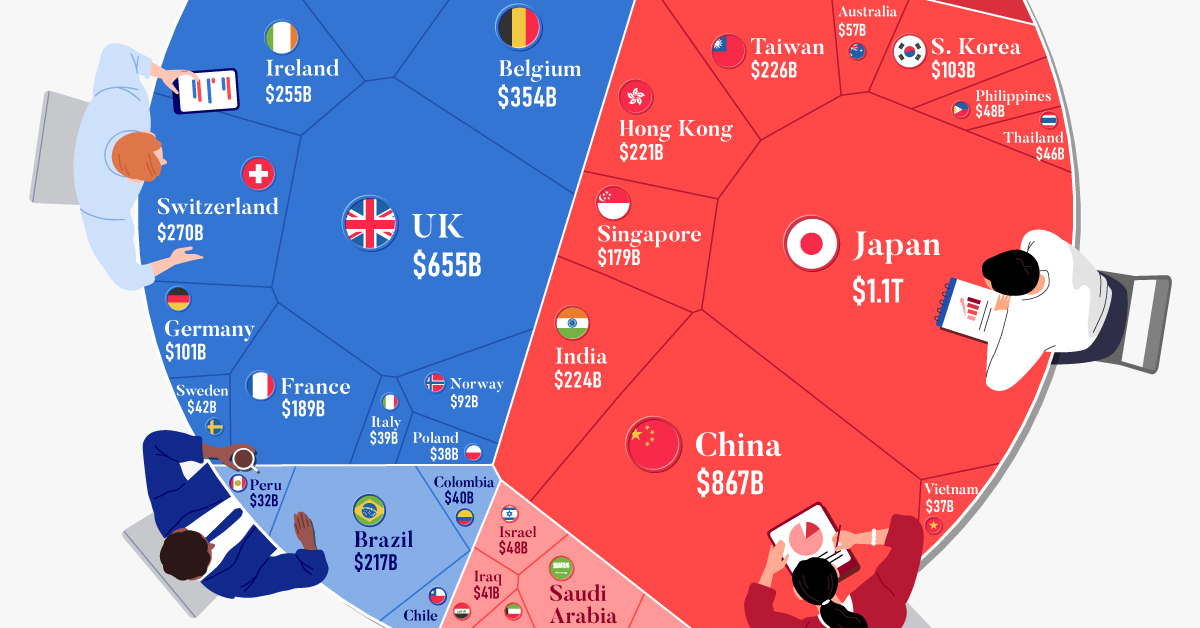

Top Foreign Holders of U.S. Debt

With $1.1 trillion in Treasury holdings, Japan is the largest foreign holder of U.S. debt. Japan surpassed China as the top holder in 2019 as China shed over $250 billion, or 30% of its holdings in four years. This bond offloading by China is the one way the country can manage the yuan’s exchange rate. This is because if it sells dollars, it can buy the yuan when the currency falls. At the same time, China doesn’t solely use the dollar to manage its currency—it now uses a basket of currencies. Here are the countries that hold the most U.S. debt: As the above table shows, the United Kingdom is the third highest holder, at over $655 billion in Treasuries. Across Europe, 13 countries are notable holders of these securities, the highest in any region, followed by Asia-Pacific at 11 different holders. A handful of small nations own a surprising amount of U.S. debt. With a population of 70,000, the Cayman Islands own a towering amount of Treasury bonds to the tune of $284 billion. There are more hedge funds domiciled in the Cayman Islands per capita than any other nation worldwide. In fact, the four smallest nations in the visualization above—Cayman Islands, Bermuda, Bahamas, and Luxembourg—have a combined population of just 1.2 million people, but own a staggering $741 billion in Treasuries.

Interest Rates and Treasury Market Dynamics

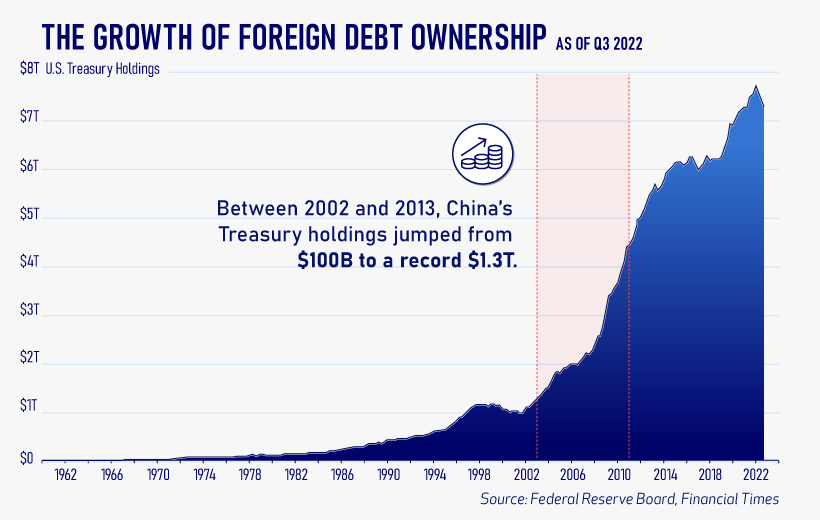

Over 2022, foreign demand for Treasuries sank 6% as higher interest rates and a strong U.S. dollar made owning these bonds less profitable. This is because rising interest rates on U.S. debt makes the present value of their future income payments lower. Meanwhile, their prices also fall. As the chart below shows, this drop in demand is a sharp reversal from 2018-2020, when demand jumped as interest rates hovered at historic lows. A similar trend took place in the decade after the 2008-09 financial crisis when U.S. debt holdings effectively tripled from $2 to $6 trillion.

Driving this trend was China’s rapid purchase of Treasuries, which ballooned from $100 billion in 2002 to a peak of $1.3 trillion in 2013. As the country’s exports and output expanded, it sold yuan and bought dollars to help alleviate exchange rate pressure on its currency. Fast-forward to today, and global interest-rate uncertainty—which in turn can impact national currency valuations and therefore demand for Treasuries—continues to be a factor impacting the future direction of foreign U.S. debt holdings.