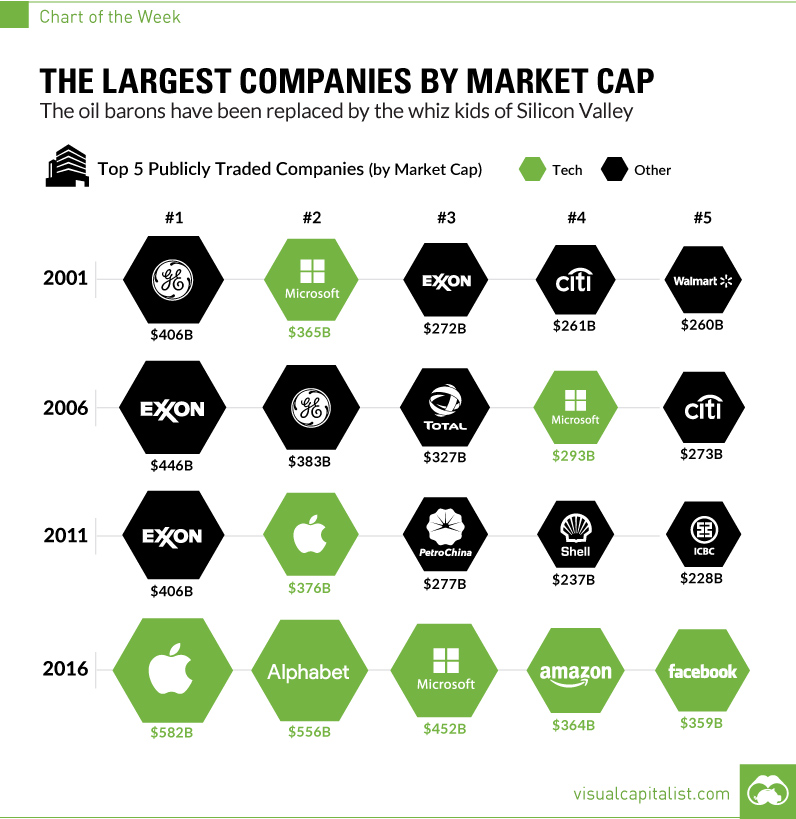

Chart: The Largest Companies by Market Cap Over 15 Years

The Oil Barons have been replaced by the Whiz Kids of Silicon Valley

The Chart of the Week is a weekly Visual Capitalist feature on Fridays. By definition, the largest companies by market cap are the most valued by investors in absolute terms. At the end of the day, however, a snapshot of the largest companies at a given time tells us what the market valued the most. And as this week’s chart shows, this simple data series can also tell us a surprising amount about the macroeconomic story over recent years.

Energy Downturn, Tech Upturn

In 2001, oil was about $30/bbl. Only one oil company (Exxon) cracked the top five list by market cap at the time. Fast forward a decade, when oil prices soared to the $100/bbl neighborhood. At this point, three of five of the largest companies by market cap were now in the oil business: Exxon, PetroChina, and Royal Dutch Shell.

Scale is in Style

Well, scale has always been in style, but now it is achievable in ways like never before. To reach more people, Walmart had to build more stores, expand complex supply chains, and hire new employees. This takes a lot of capital and manpower, and the stakes are high for each new expansion. The world’s best tech companies are also able to gain competitive advantages that are extremely difficult to supplant. While oil companies are fighting over a limited supply and have a commoditized end product, Google and Facebook have key businesses that are truly unique and the best at what they do. For these reasons, tech is likely to top the leaderboard for the largest companies by market cap for the foreseeable future. on Today’s chart measures the extent to which 41 major economies are reopening, by plotting two metrics for each country: the mobility rate and the COVID-19 recovery rate: Data for the first measure comes from Google’s COVID-19 Community Mobility Reports, which relies on aggregated, anonymous location history data from individuals. Note that China does not show up in the graphic as the government bans Google services. COVID-19 recovery rates rely on values from CoronaTracker, using aggregated information from multiple global and governmental databases such as WHO and CDC.

Reopening Economies, One Step at a Time

In general, the higher the mobility rate, the more economic activity this signifies. In most cases, mobility rate also correlates with a higher rate of recovered people in the population. Here’s how these countries fare based on the above metrics. Mobility data as of May 21, 2020 (Latest available). COVID-19 case data as of May 29, 2020. In the main scatterplot visualization, we’ve taken things a step further, assigning these countries into four distinct quadrants:

1. High Mobility, High Recovery

High recovery rates are resulting in lifted restrictions for countries in this quadrant, and people are steadily returning to work. New Zealand has earned praise for its early and effective pandemic response, allowing it to curtail the total number of cases. This has resulted in a 98% recovery rate, the highest of all countries. After almost 50 days of lockdown, the government is recommending a flexible four-day work week to boost the economy back up.

2. High Mobility, Low Recovery

Despite low COVID-19 related recoveries, mobility rates of countries in this quadrant remain higher than average. Some countries have loosened lockdown measures, while others did not have strict measures in place to begin with. Brazil is an interesting case study to consider here. After deferring lockdown decisions to state and local levels, the country is now averaging the highest number of daily cases out of any country. On May 28th, for example, the country had 24,151 new cases and 1,067 new deaths.

3. Low Mobility, High Recovery

Countries in this quadrant are playing it safe, and holding off on reopening their economies until the population has fully recovered. Italy, the once-epicenter for the crisis in Europe is understandably wary of cases rising back up to critical levels. As a result, it has opted to keep its activity to a minimum to try and boost the 65% recovery rate, even as it slowly emerges from over 10 weeks of lockdown.

4. Low Mobility, Low Recovery

Last but not least, people in these countries are cautiously remaining indoors as their governments continue to work on crisis response. With a low 0.05% recovery rate, the United Kingdom has no immediate plans to reopen. A two-week lag time in reporting discharged patients from NHS services may also be contributing to this low number. Although new cases are leveling off, the country has the highest coronavirus-caused death toll across Europe. The U.S. also sits in this quadrant with over 1.7 million cases and counting. Recently, some states have opted to ease restrictions on social and business activity, which could potentially result in case numbers climbing back up. Over in Sweden, a controversial herd immunity strategy meant that the country continued business as usual amid the rest of Europe’s heightened regulations. Sweden’s COVID-19 recovery rate sits at only 13.9%, and the country’s -93% mobility rate implies that people have been taking their own precautions.

COVID-19’s Impact on the Future

It’s important to note that a “second wave” of new cases could upend plans to reopen economies. As countries reckon with these competing risks of health and economic activity, there is no clear answer around the right path to take. COVID-19 is a catalyst for an entirely different future, but interestingly, it’s one that has been in the works for a while. —Carmen Reinhart, incoming Chief Economist for the World Bank Will there be any chance of returning to “normal” as we know it?