Where are the Ultra-Rich Buying Luxury Homes?

Ranking the world’s best cities for luxury

The Chart of the Week is a weekly Visual Capitalist feature on Fridays. Whether it’s a 10,000 sq. ft mansion in Bel Air, or a classy penthouse in Monaco with a harbor view, the buyers of top-end real estate tend to be very particular. In fact, the most robust markets for luxury real estate can be found concentrated in only a few world-class cities like Hong Kong, London, or New York, or in luxury destinations like Cannes or The Hamptons. These are all timeless locations that have the amenities and activities to appeal to large amounts of high net worth individuals. But at the same time, what is trending at any given time is a lot less predictable. Only so many homes change hands every year, and they do so based on global macroeconomic trends, the political environment, changing tastes, speculation, and shifts at a local level. In the luxury home market, one year’s boom is another year’s bust – it just depends on who is buying and selling, and why.

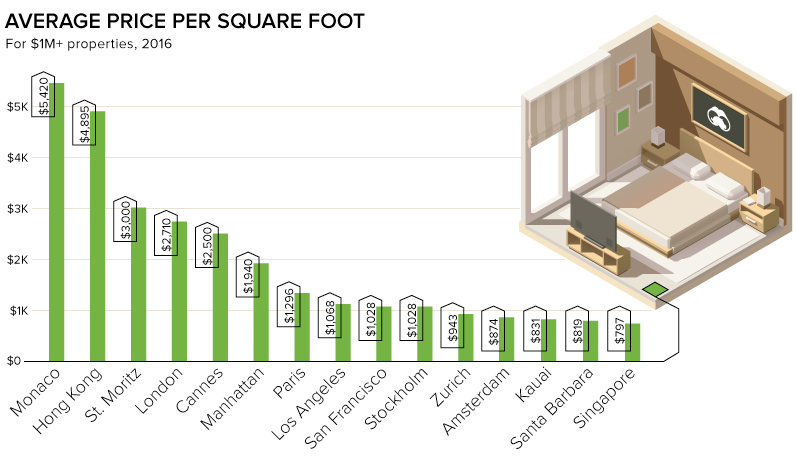

Price Disparity for Luxury

As with all real estate, pricing is not uniform across the board. In the city-state of Monaco, it costs $5,420 per square foot for top-end real estate. Interestingly, the same space can be bought for a fraction of the cost for only $1,068 in Los Angeles or $831 in Hawaii (Kauai).

This is yet another factor to consider in where the rich are buying. Is it worth it to go a bit over the top and buy a house on The Peak in Hong Kong, or will a mansion in Singapore suffice at a 84% discount?

Timeless vs. Hot Markets

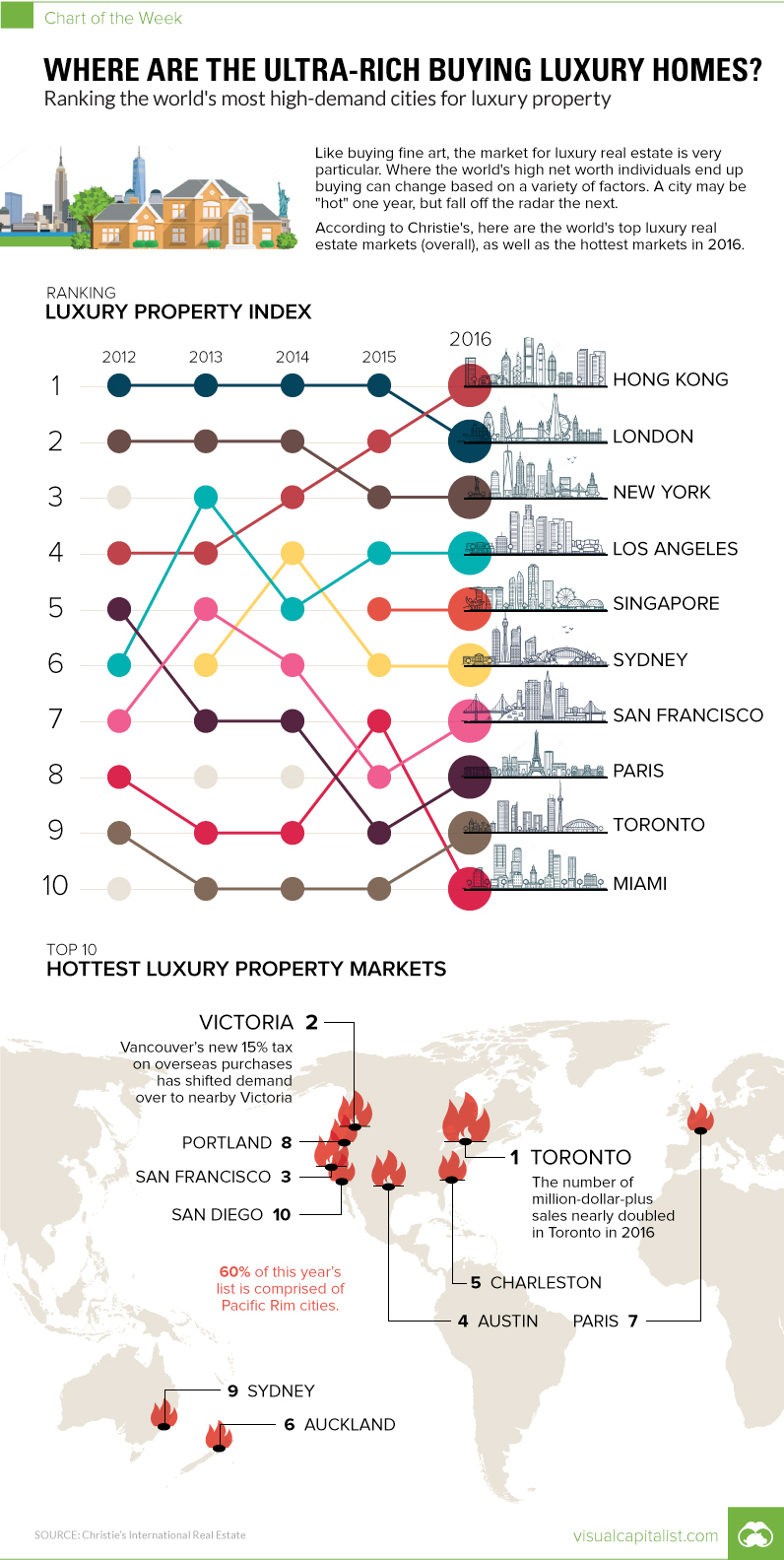

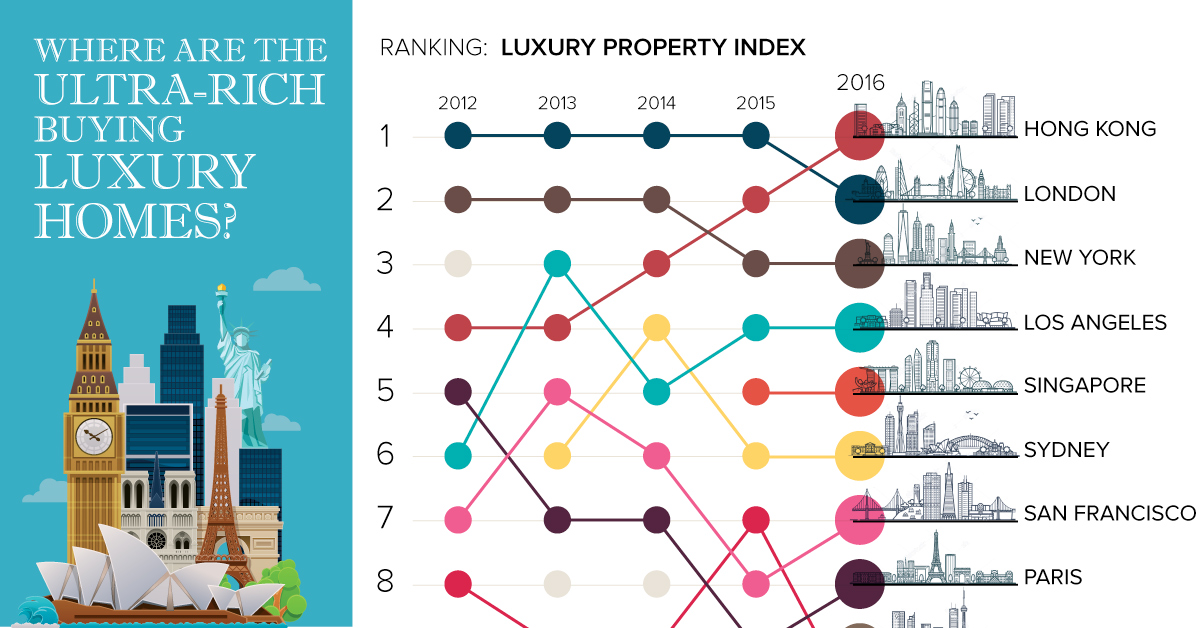

In a 2017 whitepaper from Christie’s International Real Estate, markets are ranked based on two ideas: the Luxury Index and the Luxury Thermometer. The former rates timeless markets, like New York and Hong Kong, which tend to have the most luxury sales overall. The latter does so based on what’s “hot” and trending upwards in a given year. These may not necessarily be the biggest markets, but they are ones that are getting an influx of new activity and interest from buyers. The Luxury Index In the aftermath of Brexit, Christie’s noted that sales in London of $1 million+ primary homes declined by -35% in 2016. It’s no surprise then, that Hong Kong has displaced London as the top city for prime real estate sales according to the index. The Luxury Thermometer The Canadian market continues to be madness, with luxury sales up 83%. We previously documented Vancouver’s real estate mania, but the city has since implemented a 15% tax on overseas buyers. As a result, these buyers are turning increasingly towards nearby Victoria, BC, Canada, the #2 ranked city on the Luxury Thermometer in 2016.

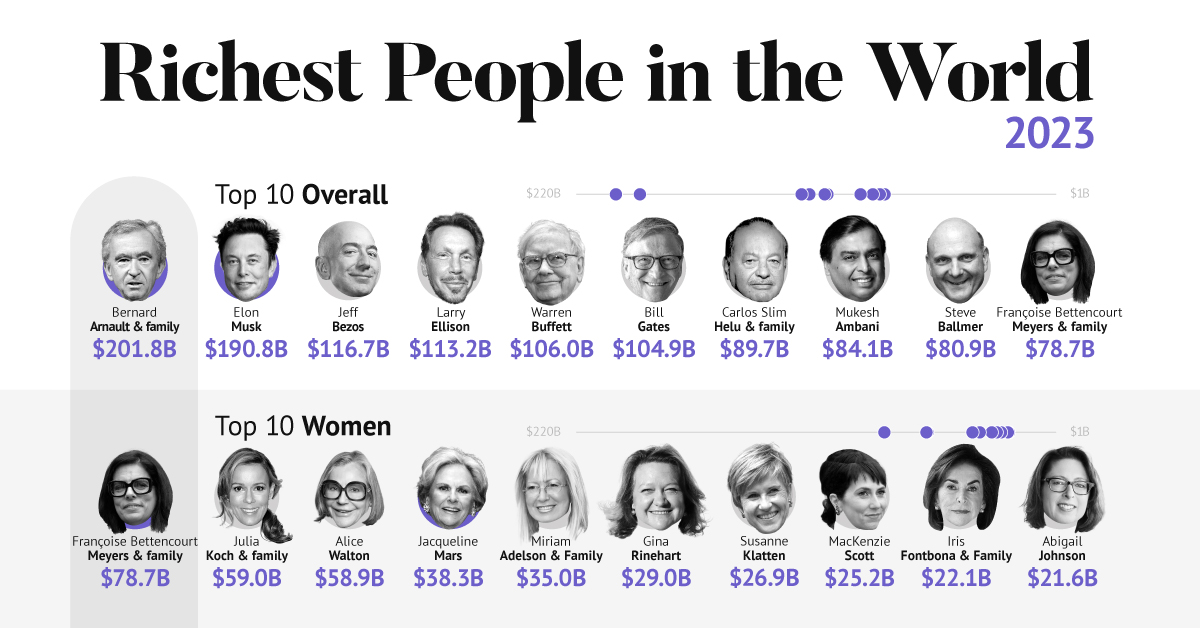

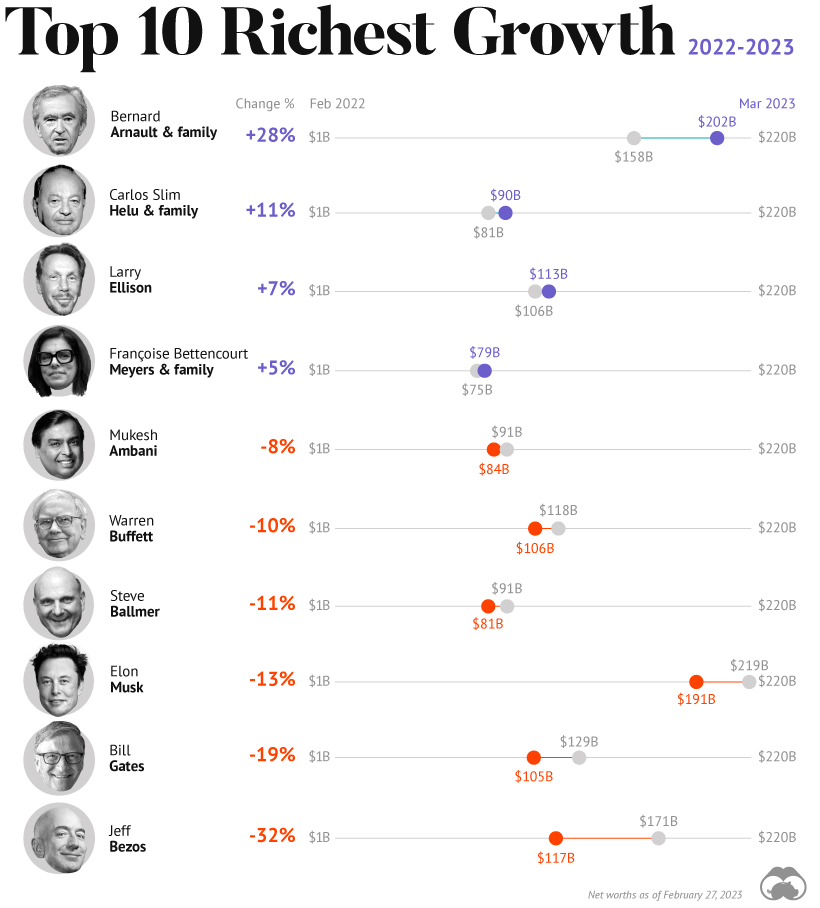

on A lagging stock market dented these fortunes against high interest rates, energy shocks, and economic uncertainty. But some of the world’s billionaires have flourished in this environment, posting sky-high revenues in spite of inflationary pressures. With data from Forbes Real-Time Billionaires List, we feature a snapshot of the richest people in the world in 2023.

Luxury Mogul Takes Top Spot

The world’s richest person is France’s Bernard Arnault, the chief executive of LVMH.

With 75 brands, the luxury conglomerate owns Louis Vuitton, Christian Dior, and Tiffany. LVMH traces back to 1985, when Arnault cut his first major deal with the company by acquiring Christian Dior, a firm that was struggling with bankruptcy.

Fast-forward to today, and the company is seeing record profits despite challenging market conditions. Louis Vuitton, for instance, has doubled its sales in four years.

In the table below, we show the world’s 10 richest people with data as of February 27, 2023:

Elon Musk, the second-wealthiest person in the world has a net worth of $191 billion. In October, Musk took over Twitter in a $44 billion dollar deal, which has drawn criticism from investors. Many say it’s a distraction from Musk’s work with Tesla.

While Tesla shares have rebounded—after falling roughly 70% in 2022—Musk’s wealth still sits about 13% lower than in March of last year.

Third on the list is Jeff Bezos, followed by Larry Ellison. The latter of the two, who founded Oracle, owns 98% of the Hawaiian island of Lanai which he bought in 2012 for $300 million.

Fifth on the list is Warren Buffett. In his annual letter to shareholders, he discussed how Berkshire Hathaway reported record operating profits despite economic headwinds. The company outperformed the S&P 500 Index by about 22% in 2022.

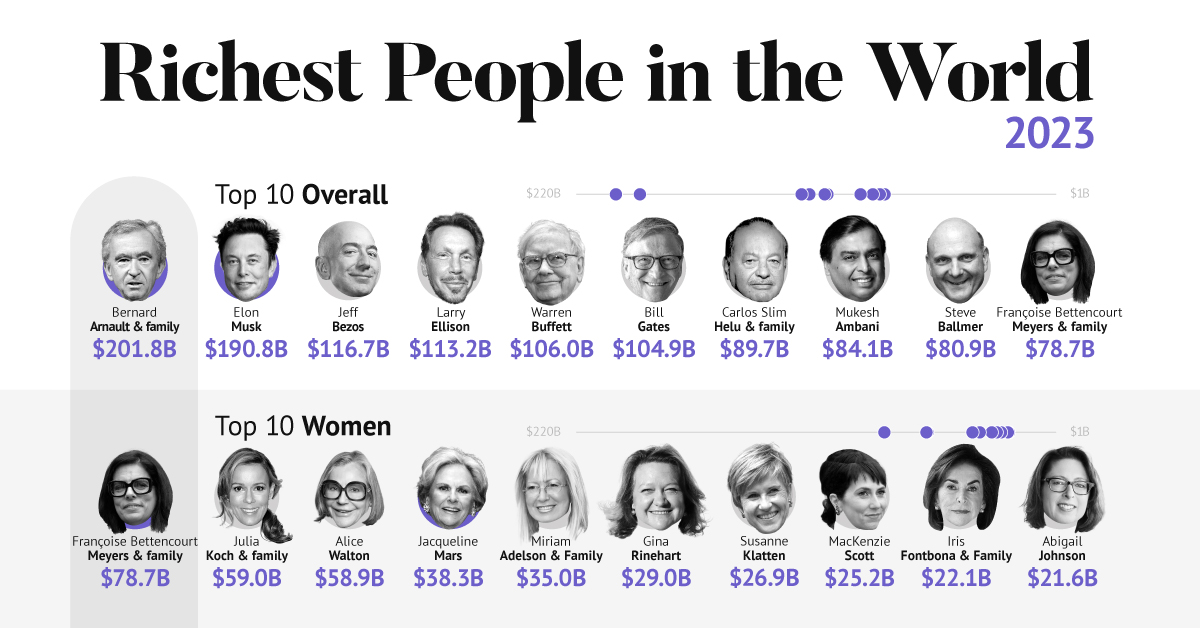

How Fortunes Have Changed

Given multiple economic crosscurrents, billionaire wealth has diverged over the last year. Since March 2022, just four of the top 10 richest in the world have seen their wealth increase. Two of these are European magnates, while Carlos Slim Helu runs the largest telecom firm in Latin America. In fact, a decade ago Slim was the richest person on the planet. Overall, as the tech sector saw dismal returns over the year, the top 10 tech billionaires lost almost $500 billion in combined wealth.

Recent Shakeups in Asia

Perhaps the most striking news for the world’s richest centers around Gautam Adani, formerly the richest person in Asia. In January, Hindenburg Research, a short-selling firm, released a report claiming that the Adani Group engaged in stock manipulation and fraud. Specifically, the alleged the firm used offshore accounts to launder money, artificially boost share prices, and hide losses. The Adani Group, which owns India’s largest ports—along with ports in Australia, Sri Lanka, and Israel—lost $100 billion in value in the span of a few weeks. Interestingly, very few Indian mutual funds hold significant shares in Adani Group, signaling a lack of confidence across India’s market, which was also cited in Hindenburg’s report. As a result, Mukesh Ambani has climbed to Asia’s top spot, controlling a $84 billion empire that spans from oil and gas and renewable energy to telecom. His conglomerate, Reliance Industries is the largest company by market cap in India.