In this infographic from McKinsey & Co., we outline the financial vulnerabilities of Black Americans, their increased usage of financial services since the onset of the pandemic, and their lower satisfaction levels with those services.

Financial Vulnerabilities of Black Americans

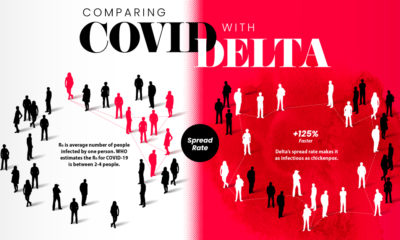

Compared to White Americans, more Black Americans say their job and income have been negatively impacted by COVID-19. Looking forward, Black Americans also report greater job security concerns and have less savings to protect themselves financially. In the event of a job loss, 57% of Black Americans report their savings would last four months or less, compared with 44% of White Americans. With less of a cash buffer on hand, Black consumers are also more likely to have missed a recent bill payment. This includes being unable to pay for basic items such as utilities, telephone and internet, and mortgage payments. How do they begin to manage these challenges?

Use of Financial Services

Black Americans increased their use of financial services more than White Americans. Banking activities in the past two weeks, per March-June 2020 surveys For example, Black Americans were about twice as likely to request account service, open an account, or receive advice on digital tools. In addition, Black families were more likely to leverage a fintech platform and have been more active in opening fintech accounts since the start of the COVID-19 crisis. However, as Black Americans seek out more financial help, some are not happy with the service they receive.

Satisfaction with Financial Services

Overall, Black families are less satisfied than White families across all types of financial activities. These differences were most pronounced for digital tool advice, where 38% of Black Americans were dissatisfied or very dissatisfied, compared with just 12% of White Americans. Even though Black people were less satisfied with banking services, they were more likely to say that bank performance was above their expectations. This may suggest that expectations are lower for Black families than they are for White families. Black Americans were also much less likely to trust their financial advisor. From March-June 2020, the percentage of Black people distrusting their advisors rose from 12% to 32%. Over the same time period, White people’s distrust of financial advisors remained stable at 10%. A notable exception: White and Black Americans were both satisfied with fintech providers. Only 5% of White Americans and 8% of Black Americans expressed some level of dissatisfaction with fintech companies.

Time to Examine the Financial System?

COVID-19 has perpetuated Black-White financial inequality. Data shows that Black families are more likely to be financially vulnerable, and increase their use of financial services during the COVID-19 crisis. However, they are less likely to feel satisfied with these services. Financial institutions can urgently review their remote and in-person customer service procedures to ensure the needs of all families are being met. on Together, BRICS represents 26.7% of the world’s land surface and 41.5% of its population. By GDP ranking, they’re also some of the most powerful economies in the world. But what drives their economies? We’re highlighting the top 10 biggest companies in each country, starting with Brazil.

What Are the Biggest Public Companies in Brazil?

Brazil isn’t just one of the largest and most diverse countries in the world, it is also an economic powerhouse. With over 213 million people, Brazil is the sixth most populous country on Earth and the largest in Latin America. It’s also the wealthiest on the continent, with the world’s 12th-largest economy. Once a colony focused on sugar and gold, Brazil rapidly industrialized in the 20th century. Today, it is a top 10 exporter of industrial steel, with the country’s economic strength coming chiefly from natural resources and financials. Here are Brazil’s biggest public companies by market capitalization in October 2021: At the top of the ranking is Vale, a metals and mining giant that is the world’s largest producer of iron ore and nickel. Also the operator of infrastructure including hydroelectricity plants, railroads, and ports, It consistently ranks as the most valuable company in Latin America. Vale and second-ranking company Petróleo Brasileiro, Brazil’s largest oil producer, were former state-owned corporations that became privatized in the 1990s.

Finance in Brazil’s Top 10 Biggest Companies

Other than former monopolies, the top 10 biggest companies in Brazil highlight the power of the banking sector.

Five of the 10 companies with a market cap above $20 billion are in the financial industry.

They include Itaú Unibanco, the largest bank in the Southern Hemisphere, and Banco Santander Brasil, the Brazilian subsidiary of Spanish finance corp.

Another well-known subsidiary is brewing company Ambev, which produces the majority of the country’s liquors and also bottles and distributes PepsiCo products in much of Latin America. Ambev is an important piece of Belgian drink juggernaut Anheuser-Busch InBev, which is one of the world’s largest 100 companies.

What other companies or industries do you associate with Brazil?

Correction: Two companies listed had errors in their market cap calculations and have been updated. All data is as of October 11, 2021.