While it’s hard to know what this newest generation of investors will do once the funds hit their accounts, there is no shortage of speculation about the habits and attitudes that will characterize their collective approach to wealth management as they age.

Surveying Millennial Investors

Today’s infographic is the result of a partnership with our friends at Morning Brew, a daily business briefing newsletter that skews towards a millennial audience. It showcases the results of their recent audience survey, which had 9,800 respondents from North America and Europe. All respondents fell between the ages of 18 and 35, representing a group that roughly equates to the business leaders of tomorrow. The survey’s aim: to get a peek at their current financial habits and attitudes towards investing.

Who is Investing?

Of the respondents, a majority of 68.1% is employed full-time while another 27.6% identified as students. The remaining 4.2% is employed part-time or answered “other”. Financial goals for these respondents were quite diversified, as seen below. Primary financial goal:

23.8% – Earning a graduate/master’s degree 21.5% – Buying a car 19.6% – Getting married 19.0% – Buying a primary home 7.3% – Opening a business 6.4% – Having a child 2.3% – Buying a vacation home

It’s worth keeping in mind that people in this segment can be at very different stages in their lives. Those at the lower end (18-22 years) are just starting their adult years, while those at the higher end (30-35 years) can be quite a ways into their professional careers.

Portfolio Size and Composition

The vast majority of the cohort surveyed said they invest (89%), with the most common bracket of money invested rising steadily as respondents got older:

18 to 22 years old: $1,001-$5,000 (31.7%) 23 to 27 years old: $10,001-$50,000 (36.7%) 28 to 35 years old: $50,000+ (42.0%)

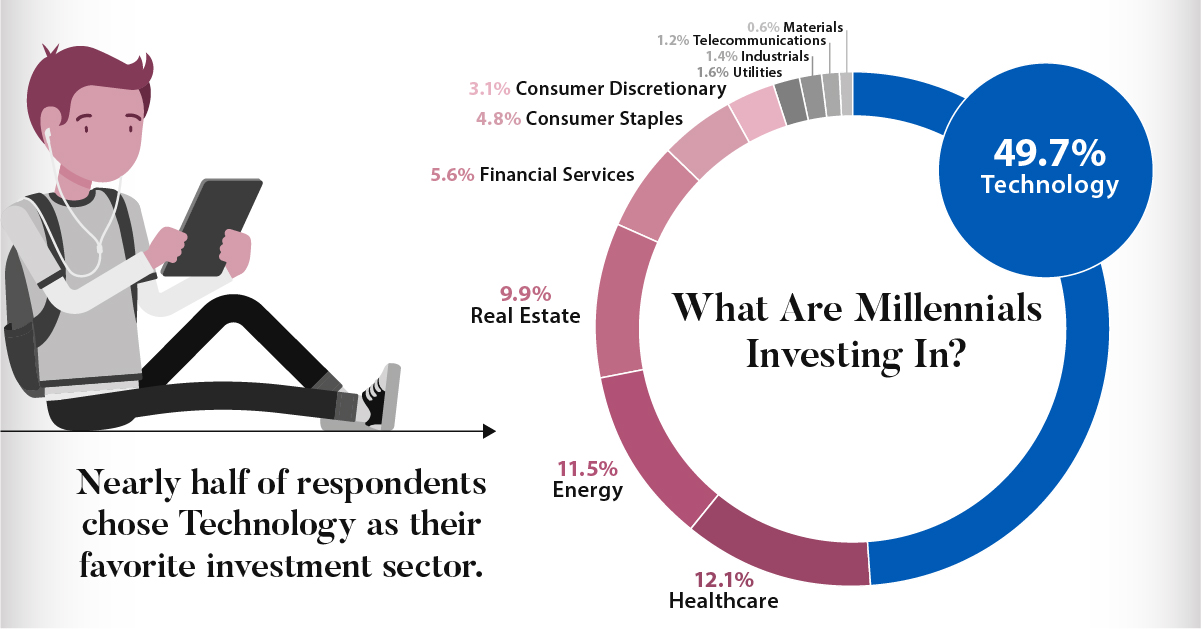

Not surprisingly, technology was the preferred sector to invest in for many in the pool of respondents. Nearly half of people (49.7%) said tech was their favorite sector, with healthcare (12.1%), energy (11.5%), and real estate (9.9%) appearing on the radar as well. Many sectors were underrepresented here, with financial services (5.6%), consumer staples (4.8%), and consumer discretionary (3.1%) having a relatively low amount of interest. Even worse off were the utilities, industrials, telecommunications, and materials sectors, which held virtually no interest (<2%) among millennial investors.

Millennial Investing Habits

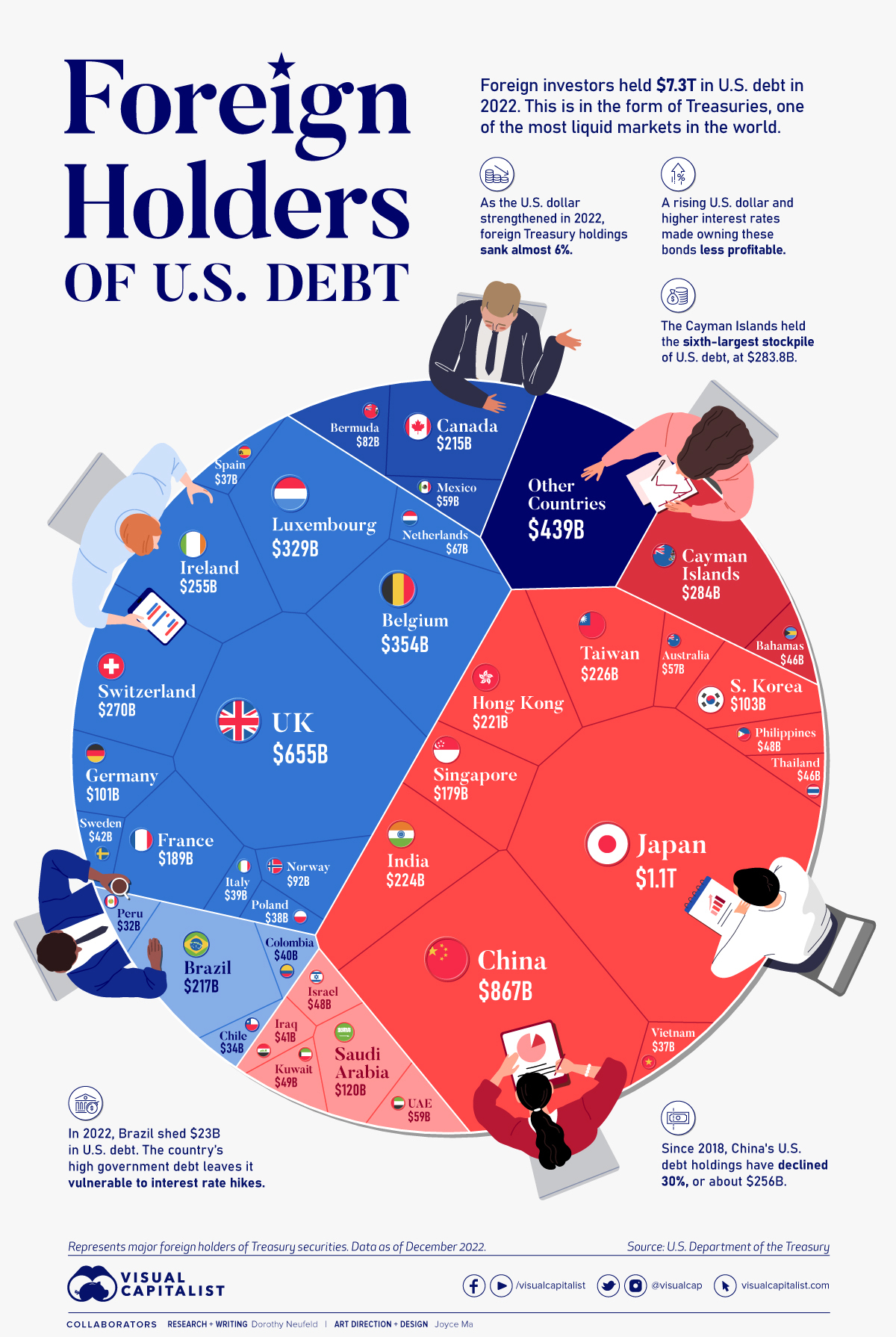

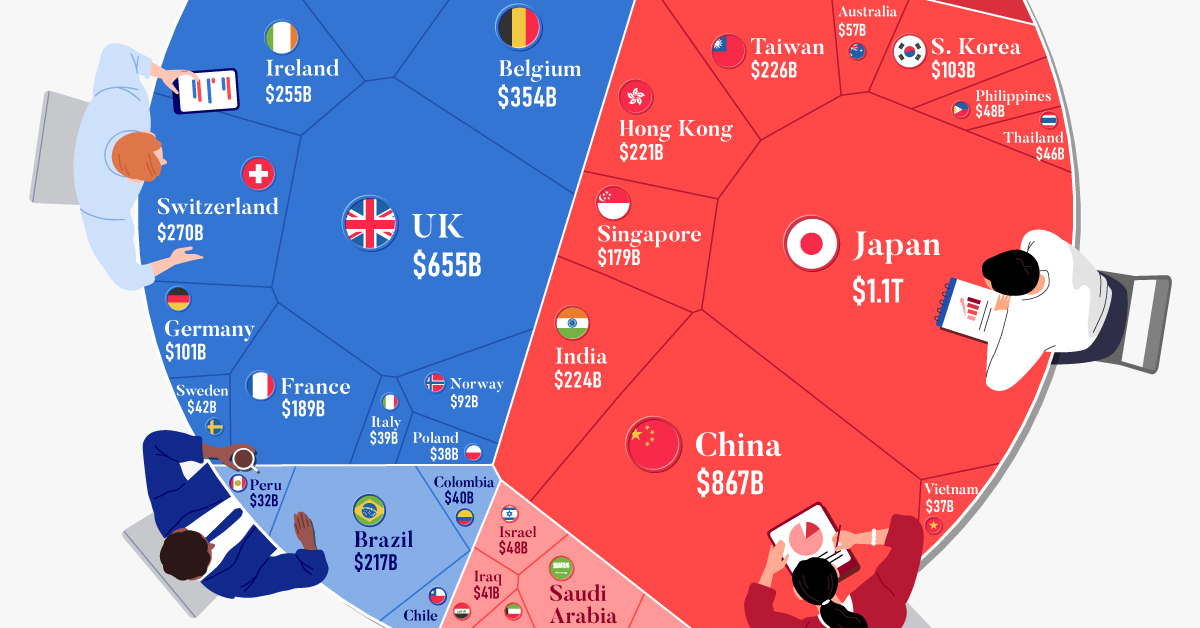

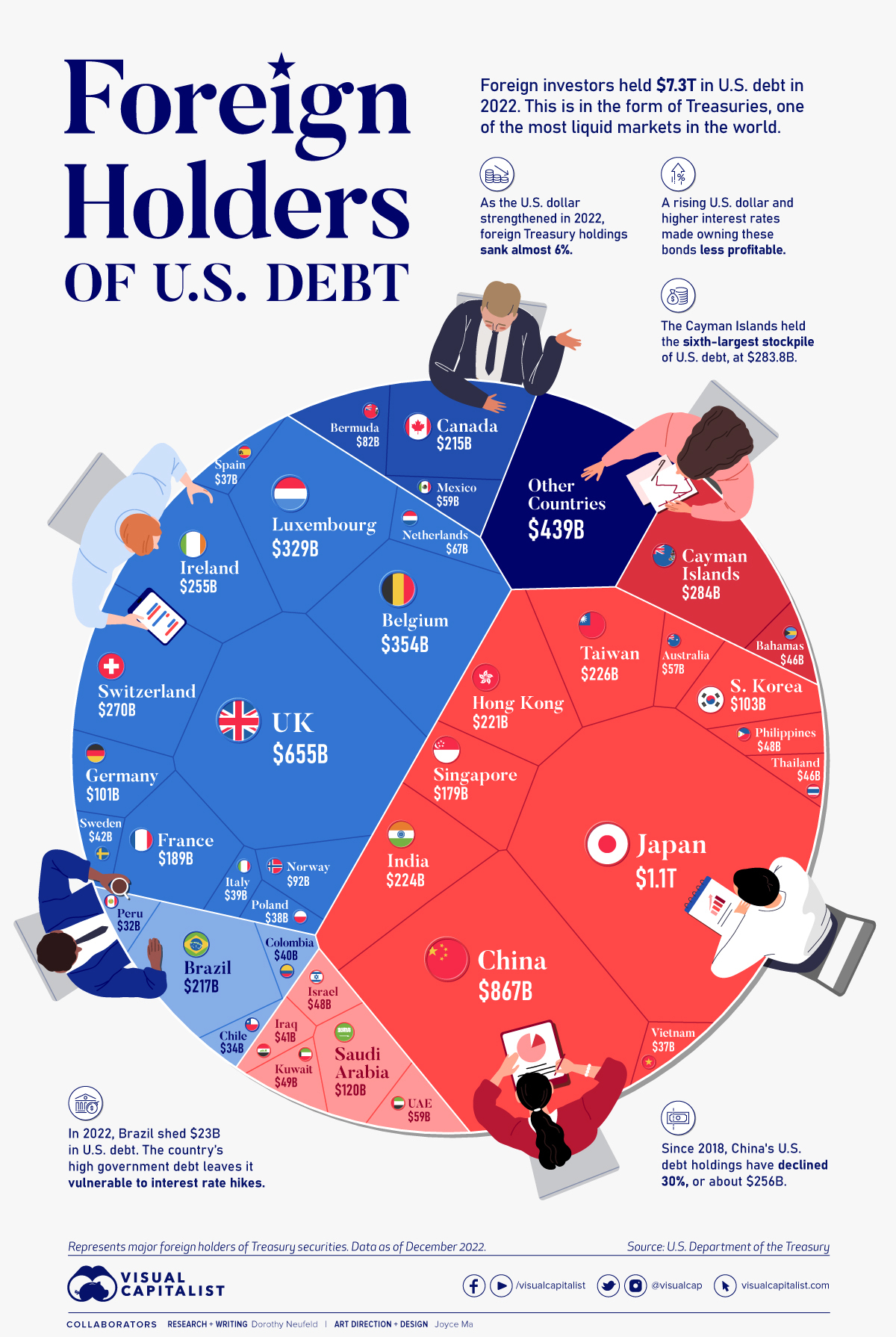

Millennials rate their level of expertise in investing as pretty limited, with only 18.3% of respondents expressing that they had high confidence in their own investment abilities. This is a finding that is consistent with the growing financial literacy problem in America. The respondents preferred the human touch of financial advisors (70.2%) to robo advisors (29.9%), and were lukewarm towards social impact investing with only 21.1% seeing it as being very important. As a final exclamation point on the survey results, millennial investors were very clear on what was important to them, and it’s low fees. When asked how they decide on a professional service, 42.4% saw low fees as a top three deciding factor. At the same time, simplicity (11.6%) and breadth of asset classes (13.1%) were well behind in importance. on These are in the form of Treasury securities, some of the most liquid assets worldwide. Central banks use them for foreign exchange reserves and private investors flock to them during flights to safety thanks to their perceived low default risk. Beyond these reasons, foreign investors may buy Treasuries as a store of value. They are often used as collateral during certain international trade transactions, or countries can use them to help manage exchange rate policy. For example, countries may buy Treasuries to protect their currency’s exchange rate from speculation. In the above graphic, we show the foreign holders of the U.S. national debt using data from the U.S. Department of the Treasury.

Top Foreign Holders of U.S. Debt

With $1.1 trillion in Treasury holdings, Japan is the largest foreign holder of U.S. debt. Japan surpassed China as the top holder in 2019 as China shed over $250 billion, or 30% of its holdings in four years. This bond offloading by China is the one way the country can manage the yuan’s exchange rate. This is because if it sells dollars, it can buy the yuan when the currency falls. At the same time, China doesn’t solely use the dollar to manage its currency—it now uses a basket of currencies. Here are the countries that hold the most U.S. debt: As the above table shows, the United Kingdom is the third highest holder, at over $655 billion in Treasuries. Across Europe, 13 countries are notable holders of these securities, the highest in any region, followed by Asia-Pacific at 11 different holders. A handful of small nations own a surprising amount of U.S. debt. With a population of 70,000, the Cayman Islands own a towering amount of Treasury bonds to the tune of $284 billion. There are more hedge funds domiciled in the Cayman Islands per capita than any other nation worldwide. In fact, the four smallest nations in the visualization above—Cayman Islands, Bermuda, Bahamas, and Luxembourg—have a combined population of just 1.2 million people, but own a staggering $741 billion in Treasuries.

Interest Rates and Treasury Market Dynamics

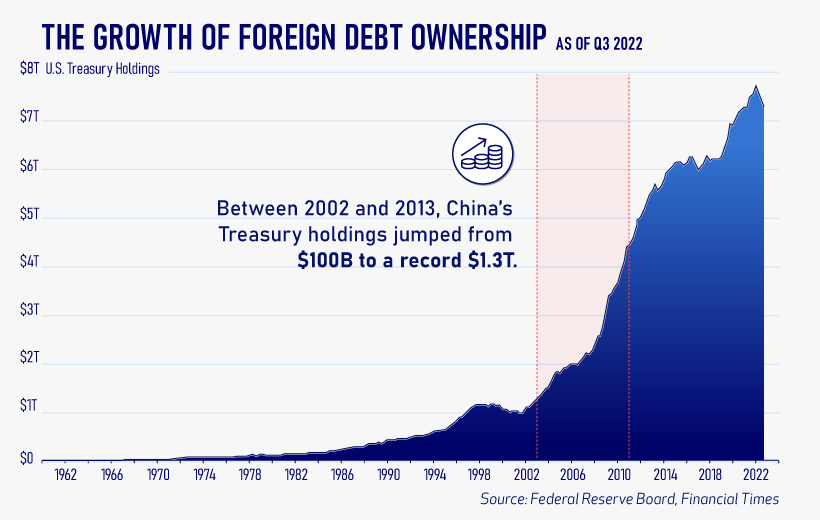

Over 2022, foreign demand for Treasuries sank 6% as higher interest rates and a strong U.S. dollar made owning these bonds less profitable. This is because rising interest rates on U.S. debt makes the present value of their future income payments lower. Meanwhile, their prices also fall. As the chart below shows, this drop in demand is a sharp reversal from 2018-2020, when demand jumped as interest rates hovered at historic lows. A similar trend took place in the decade after the 2008-09 financial crisis when U.S. debt holdings effectively tripled from $2 to $6 trillion.

Driving this trend was China’s rapid purchase of Treasuries, which ballooned from $100 billion in 2002 to a peak of $1.3 trillion in 2013. As the country’s exports and output expanded, it sold yuan and bought dollars to help alleviate exchange rate pressure on its currency. Fast-forward to today, and global interest-rate uncertainty—which in turn can impact national currency valuations and therefore demand for Treasuries—continues to be a factor impacting the future direction of foreign U.S. debt holdings.