During the longest bull market in modern history, the S&P 500 surged a whopping 418% over the 9.5 years between November 1990 and March 2000. This was during the famous economic expansion that took place during the Clinton era, in which job growth was robust, oil prices fell, stocks soared, and making money was as easy as throwing it in the stock market. In mere months, this famed bull market may lose its title as the “longest” in the modern era. That’s because, according to data and analysis from LDL Research, the current bull market will take over the claim to fame in late August 2018.

Ranking the Bulls

In today’s chart, we show every bull market since WWII, including the top six which are covered in more detail:

By looking at duration, total rate of return, and annualized rate of return, it really gives a sense of how these bull markets compare. The current run, which will soon become the longest, didn’t have the same level of intensity as other high-ranking bull markets. Critics would say that it was artificially propped up by ultra-low rates, QE, and other government actions that will make the market ultimately less robust heading forward. Regardless, the current run ranks in fourth place among the markets above in terms of annualized return.

What Ended Each Bull?

The market psychology behind bull and bear markets can be fascinating. Below we look at the events credited with “ending” each bull market – though of course, it is actually the actions of investors (buying or selling) that ultimately dictates market direction.

- The Great Expansion The bull run lasted 9.5 years, ultimately capitulating when the Dotcom Bubble burst. From the span of June 1999 and May 2000, the Fed raised interest rates six times to try and get a “soft landing”. Market uncertainty was worsened by the 9/11 attacks that occurred the year after.

- The Post-Crisis Bull Run Still ongoing…

- The Post-War Boom This boom occurred after WWII, and it ended in 1956. Some of the sources we looked at credited the launch of Sputnik, Eisenhower’s heart attack, and the Hungarian Revolution as possible sources of market fear.

- That ’70s Growth The Iranian Revolution, the 1979 Energy Crisis, and the return of double-digit inflation were the factors blamed for the end of this bull.

- Reagan Era This bull market had the highest annualized return at 26.7%, but the party came to an end on Black Monday in 1987 – one of the most infamous market crashes ever. Some of the causes cited for the crash: program trading, overvaluation, illiquidity and market psychology.

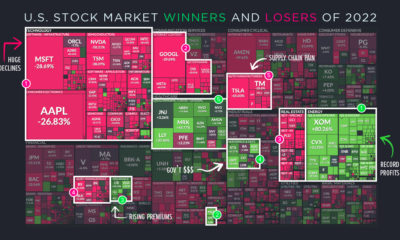

- The Hot Aughts Stocks did decently well during the era of cheap credit and rising housing prices. However, the Financial Crisis put an end to this growth, and would cut the DJIA from 14,000 points to below 6,600 points. on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.