That’s why claims about guaranteed returns or “can’t miss” opportunities can be extremely tempting when they appear. After all, many people have been grinding it out for years in the markets – and rightfully they may feel overdue for their big moment. But as always, opportunities that are too good to be true must pass the smell test. And most of the time, if you do your homework, they fail with flying colors.

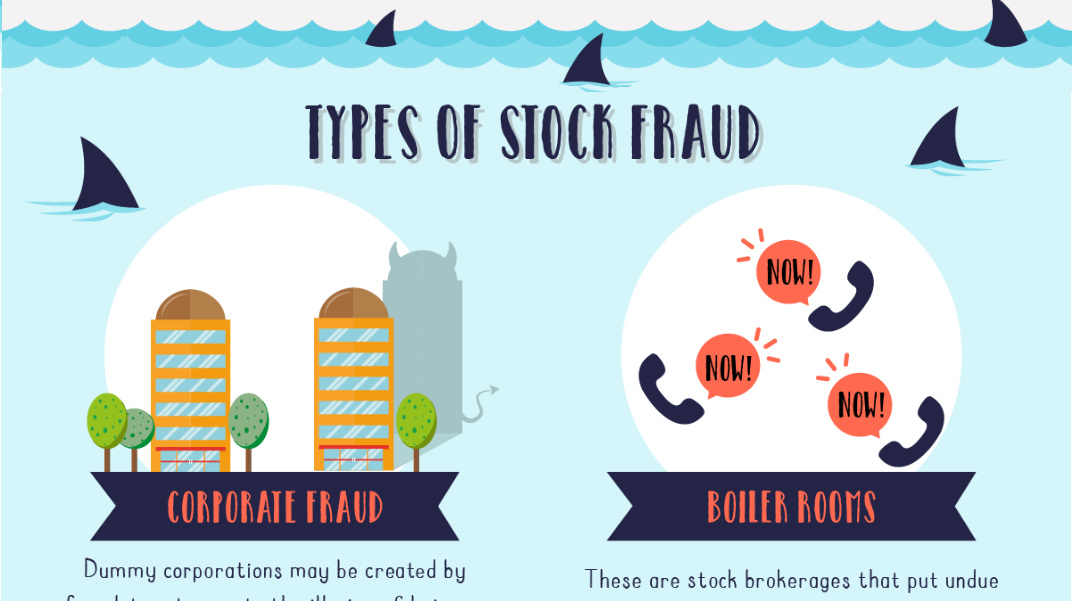

Defining Stock Fraud

Today’s infographic comes to us from StocksToTrade and it highlights stock fraud, which can be described as a violation of security law that occurs when a fraudster compels an investor to buy or sell based on false information. Importantly, there are many different varieties of stock fraud to recognize, and they all have distinct characteristics that make them unique: Corporate Fraud Using “dummy” corporations to create the illusion of representing a corporation with a similar name. Investors are then misled to buy shares in the dummy corporation, rather than the real thing. Boiler Rooms High-pressure selling technique used to peddle shares in speculative or fraudulent securities on the phone. Pump and Dump False and/or fraudulent information spread to increase the price of a thinly traded stock. When the stock hits a target price, the dumper sells to rake in substantial profits. Those left holding the stock are stuck and must sell at a loss. Insider Trading When a security is illegally traded based on material, non-public information. Short and Distort Similar to a pump and dump, this involves the spread of rumors or false information to profit from short-selling a stock. Ponzi Scheme A type of pyramid scheme where money from new investors provides the return for old investors. Prime Bank These are scams where fraudsters claim that funds will be used to buy bank instruments that don’t exist. Accounting Fraud Management intentionally manipulates accounting policies or estimates to improve financial statements. It could involve overstating revenues, understating expenses, overstating corporate assets, or understating existing liabilities.

How to Avoid Stock Fraud

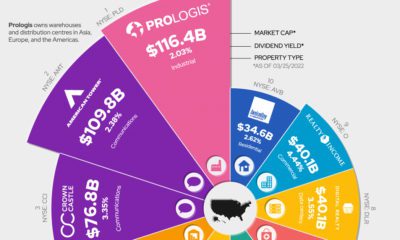

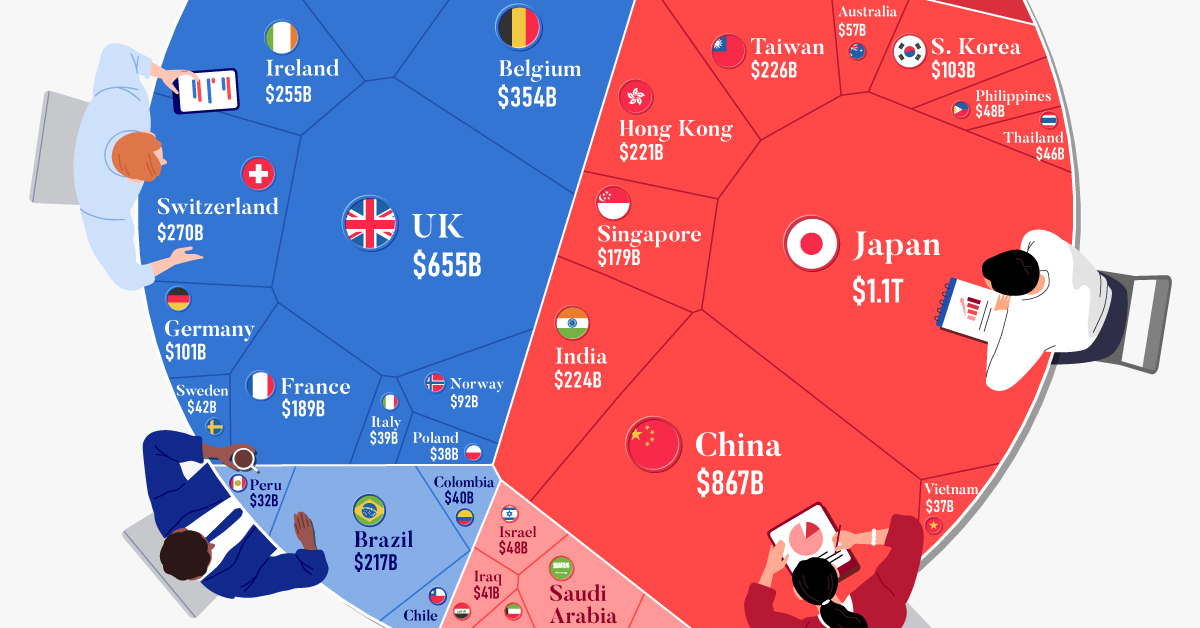

How can these potential scams be avoided? For starters, make sure you take time to do your own independent research on any security you buy. If something seems like it is overly complex, rushed, or if important information seems to be omitted, there is likely a reason for this. In a similar vein, Warren Buffett wisely advocates that a business should be simple and easy to understand, or he won’t invest in it. Further, it’s worth researching the salesperson touting the investment before making any decisions. Records from securities regulators are often one Google search away – and any disciplinary history should be known before proceeding with any transaction. on These are in the form of Treasury securities, some of the most liquid assets worldwide. Central banks use them for foreign exchange reserves and private investors flock to them during flights to safety thanks to their perceived low default risk. Beyond these reasons, foreign investors may buy Treasuries as a store of value. They are often used as collateral during certain international trade transactions, or countries can use them to help manage exchange rate policy. For example, countries may buy Treasuries to protect their currency’s exchange rate from speculation. In the above graphic, we show the foreign holders of the U.S. national debt using data from the U.S. Department of the Treasury.

Top Foreign Holders of U.S. Debt

With $1.1 trillion in Treasury holdings, Japan is the largest foreign holder of U.S. debt. Japan surpassed China as the top holder in 2019 as China shed over $250 billion, or 30% of its holdings in four years. This bond offloading by China is the one way the country can manage the yuan’s exchange rate. This is because if it sells dollars, it can buy the yuan when the currency falls. At the same time, China doesn’t solely use the dollar to manage its currency—it now uses a basket of currencies. Here are the countries that hold the most U.S. debt: As the above table shows, the United Kingdom is the third highest holder, at over $655 billion in Treasuries. Across Europe, 13 countries are notable holders of these securities, the highest in any region, followed by Asia-Pacific at 11 different holders. A handful of small nations own a surprising amount of U.S. debt. With a population of 70,000, the Cayman Islands own a towering amount of Treasury bonds to the tune of $284 billion. There are more hedge funds domiciled in the Cayman Islands per capita than any other nation worldwide. In fact, the four smallest nations in the visualization above—Cayman Islands, Bermuda, Bahamas, and Luxembourg—have a combined population of just 1.2 million people, but own a staggering $741 billion in Treasuries.

Interest Rates and Treasury Market Dynamics

Over 2022, foreign demand for Treasuries sank 6% as higher interest rates and a strong U.S. dollar made owning these bonds less profitable. This is because rising interest rates on U.S. debt makes the present value of their future income payments lower. Meanwhile, their prices also fall. As the chart below shows, this drop in demand is a sharp reversal from 2018-2020, when demand jumped as interest rates hovered at historic lows. A similar trend took place in the decade after the 2008-09 financial crisis when U.S. debt holdings effectively tripled from $2 to $6 trillion.

Driving this trend was China’s rapid purchase of Treasuries, which ballooned from $100 billion in 2002 to a peak of $1.3 trillion in 2013. As the country’s exports and output expanded, it sold yuan and bought dollars to help alleviate exchange rate pressure on its currency. Fast-forward to today, and global interest-rate uncertainty—which in turn can impact national currency valuations and therefore demand for Treasuries—continues to be a factor impacting the future direction of foreign U.S. debt holdings.