Presented by: Nevada Energy Metals, eCobalt Solutions Inc., and Great Lakes Graphite

Our Energy Problem: Putting the Battery in Context

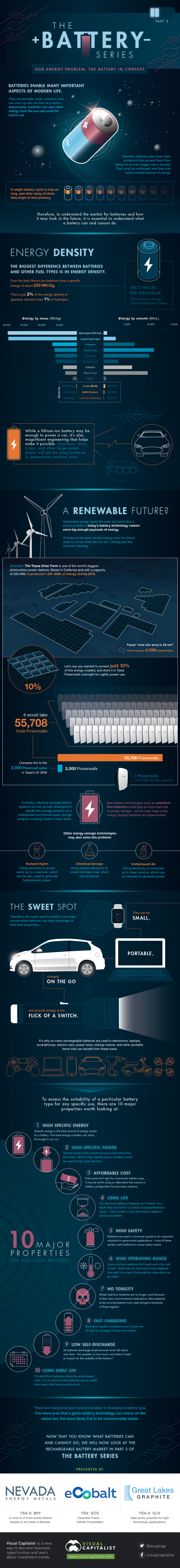

In Part 1, we examined the evolution of battery technology. In this part, we examine what batteries can and cannot do, and the energy problem that humans hope that batteries can help solve. Batteries enable many important aspects of modern life. They are portable, quiet, compact, and can start-up with the flick of a switch. Importantly, batteries can also store energy from the sun and wind for future use. However, batteries also have many limitations that prevent them from taking on an even bigger role in society. They must be recharged, and they hold a limited amount of energy. A single battery cycle is only so long, and after many of them they begin to lose potency. Therefore, to understand the market for batteries and how it may look in the future, it is essential to understand what a battery can and cannot do.

Energy Density

The biggest difference between batteries and other fuel types is in energy density. Even the best lithium-ion batteries have a specific energy of about 250 Wh/kg. That is just 2% of the energy density of gasoline, and less than 1% of hydrogen. While it may be enough to power a car, it’s also magnificent engineering that helps makes this possible. Airplanes, ships, trains, and other large power drains will not be using batteries in powertrains anytime soon.

A Renewable Future?

Renewable energy sources like solar and wind face a similar problem – today’s battery technology cannot store big enough payloads of energy. To balance the load, excess energy must be stored somehow to be used when the sun isn’t shining and the wind isn’t blowing. Currently, industrial-strength battery systems are not yet fully developed to handle this storage problem on a widespread commercial basis, though progress is being made in many areas. New technologies such as vanadium flow batteries could play an important role in energy storage in the future. But for now, large-scale energy storage batteries are experimental. Other energy storage technologies may also solve this problem:

Chemical storage: Using excess electricity to create hydrogen fuel, which can be stored. Pumped hydro: Using electricity to pump water up to a reservoir, which can be later used to generate hydroelectric power. Compressed air: Using electricity to compress air in deep caverns, which can be released to generate power.

Solving this energy storage problem will pave the way for more use of renewables in the future on a grander scale.

The Sweet Spot

Therefore, the sweet spot for battery use today comes when batteries can take advantage of their best properties. Batteries can be small, portable, charged on the go, and provide energy at the flick of a switch. It’s why so many rechargeable batteries are used in: electronics, laptops, smartphones, electric cars, power tools, startup motors, and other portable items that can benefit from these traits. To assess the suitability of a particular type for any specific use, there are 10 major properties worth looking at:

High Specific Energy: Specific energy is the total amount of energy stored by a battery. The more energy a battery can store, the longer it can run. High Specific Power: Specific power is the amount of load current drawn from the battery. Without high specific power, a battery cannot be used for the high-drain activities we need Affordable Cost: If the price isn’t right for a particular battery type, it may be worth using an alternative fuel source or battery configuration for economic reasons Long Life: The chemical makeup of batteries isn’t perfect. As a result, they only last for a number of charge/discharge cycles – if that number is low, that means a battery’s use may be limited. High Safety: Batteries are used in consumer goods or for important industrial or government applications – none of these parties want batteries to cause safety issues. Wide Operating Range: Some chemical reactions don’t work well in the cold or heat – that’s why it’s important to have batteries that work in a range of temperatures where it can be useful. No Toxicity: Nickel cadmium batteries are no longer used because of their toxic environmental implications. New batteries to be commercialized must meet stringent standards in these regards. Fast Charging: What good would a smartphone be if it took two full days to recharge? Charge time matters. Low Self-Discharge: All batteries discharge small amounts when left alone over time – the question is how much, and does it make an impact on the usability of the battery? Long Shelf Life: The shelf life of batteries affects the whole supply chain, so it is important that batteries can be usable many years after being manufactured.

There are many pros and cons to consider in choosing a battery type. The more pros that a given battery technology can check off the above list, the more likely it is to be commercially viable. Now that you know what batteries can and cannot do, we will now look at the rechargeable battery market in Part 3 of the Battery Series.

on Did you know that nearly one-fifth of all the gold ever mined is held by central banks? Besides investors and jewelry consumers, central banks are a major source of gold demand. In fact, in 2022, central banks snapped up gold at the fastest pace since 1967. However, the record gold purchases of 2022 are in stark contrast to the 1990s and early 2000s, when central banks were net sellers of gold. The above infographic uses data from the World Gold Council to show 30 years of central bank gold demand, highlighting how official attitudes toward gold have changed in the last 30 years.

Why Do Central Banks Buy Gold?

Gold plays an important role in the financial reserves of numerous nations. Here are three of the reasons why central banks hold gold:

Balancing foreign exchange reserves Central banks have long held gold as part of their reserves to manage risk from currency holdings and to promote stability during economic turmoil. Hedging against fiat currencies Gold offers a hedge against the eroding purchasing power of currencies (mainly the U.S. dollar) due to inflation. Diversifying portfolios Gold has an inverse correlation with the U.S. dollar. When the dollar falls in value, gold prices tend to rise, protecting central banks from volatility. The Switch from Selling to Buying In the 1990s and early 2000s, central banks were net sellers of gold. There were several reasons behind the selling, including good macroeconomic conditions and a downward trend in gold prices. Due to strong economic growth, gold’s safe-haven properties were less valuable, and low returns made it unattractive as an investment. Central bank attitudes toward gold started changing following the 1997 Asian financial crisis and then later, the 2007–08 financial crisis. Since 2010, central banks have been net buyers of gold on an annual basis. Here’s a look at the 10 largest official buyers of gold from the end of 1999 to end of 2021: Rank CountryAmount of Gold Bought (tonnes)% of All Buying #1🇷🇺 Russia 1,88828% #2🇨🇳 China 1,55223% #3🇹🇷 Türkiye 5418% #4🇮🇳 India 3956% #5🇰🇿 Kazakhstan 3455% #6🇺🇿 Uzbekistan 3115% #7🇸🇦 Saudi Arabia 1803% #8🇹🇭 Thailand 1682% #9🇵🇱 Poland1282% #10🇲🇽 Mexico 1152% Total5,62384% Source: IMF The top 10 official buyers of gold between end-1999 and end-2021 represent 84% of all the gold bought by central banks during this period. Russia and China—arguably the United States’ top geopolitical rivals—have been the largest gold buyers over the last two decades. Russia, in particular, accelerated its gold purchases after being hit by Western sanctions following its annexation of Crimea in 2014. Interestingly, the majority of nations on the above list are emerging economies. These countries have likely been stockpiling gold to hedge against financial and geopolitical risks affecting currencies, primarily the U.S. dollar. Meanwhile, European nations including Switzerland, France, Netherlands, and the UK were the largest sellers of gold between 1999 and 2021, under the Central Bank Gold Agreement (CBGA) framework. Which Central Banks Bought Gold in 2022? In 2022, central banks bought a record 1,136 tonnes of gold, worth around $70 billion. Country2022 Gold Purchases (tonnes)% of Total 🇹🇷 Türkiye14813% 🇨🇳 China 625% 🇪🇬 Egypt 474% 🇶🇦 Qatar333% 🇮🇶 Iraq 343% 🇮🇳 India 333% 🇦🇪 UAE 252% 🇰🇬 Kyrgyzstan 61% 🇹🇯 Tajikistan 40.4% 🇪🇨 Ecuador 30.3% 🌍 Unreported 74165% Total1,136100% Türkiye, experiencing 86% year-over-year inflation as of October 2022, was the largest buyer, adding 148 tonnes to its reserves. China continued its gold-buying spree with 62 tonnes added in the months of November and December, amid rising geopolitical tensions with the United States. Overall, emerging markets continued the trend that started in the 2000s, accounting for the bulk of gold purchases. Meanwhile, a significant two-thirds, or 741 tonnes of official gold purchases were unreported in 2022. According to analysts, unreported gold purchases are likely to have come from countries like China and Russia, who are looking to de-dollarize global trade to circumvent Western sanctions.

There were several reasons behind the selling, including good macroeconomic conditions and a downward trend in gold prices. Due to strong economic growth, gold’s safe-haven properties were less valuable, and low returns made it unattractive as an investment.

Central bank attitudes toward gold started changing following the 1997 Asian financial crisis and then later, the 2007–08 financial crisis. Since 2010, central banks have been net buyers of gold on an annual basis.

Here’s a look at the 10 largest official buyers of gold from the end of 1999 to end of 2021:

Source: IMF

The top 10 official buyers of gold between end-1999 and end-2021 represent 84% of all the gold bought by central banks during this period.

Russia and China—arguably the United States’ top geopolitical rivals—have been the largest gold buyers over the last two decades. Russia, in particular, accelerated its gold purchases after being hit by Western sanctions following its annexation of Crimea in 2014.

Interestingly, the majority of nations on the above list are emerging economies. These countries have likely been stockpiling gold to hedge against financial and geopolitical risks affecting currencies, primarily the U.S. dollar.

Meanwhile, European nations including Switzerland, France, Netherlands, and the UK were the largest sellers of gold between 1999 and 2021, under the Central Bank Gold Agreement (CBGA) framework.

Which Central Banks Bought Gold in 2022?

In 2022, central banks bought a record 1,136 tonnes of gold, worth around $70 billion. Türkiye, experiencing 86% year-over-year inflation as of October 2022, was the largest buyer, adding 148 tonnes to its reserves. China continued its gold-buying spree with 62 tonnes added in the months of November and December, amid rising geopolitical tensions with the United States. Overall, emerging markets continued the trend that started in the 2000s, accounting for the bulk of gold purchases. Meanwhile, a significant two-thirds, or 741 tonnes of official gold purchases were unreported in 2022. According to analysts, unreported gold purchases are likely to have come from countries like China and Russia, who are looking to de-dollarize global trade to circumvent Western sanctions.