This map ranks America’s best states to do business in based on a study from CNBC which measured 88 factors across 10 broad categories.

Methodology

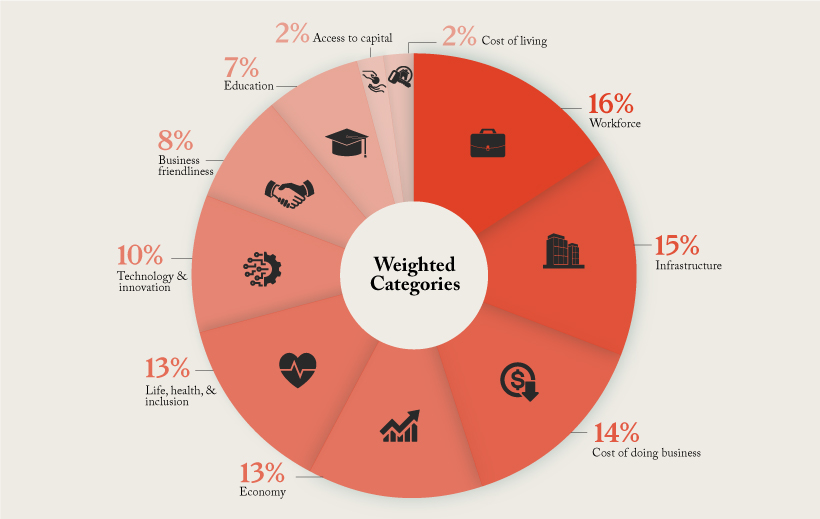

Here is a further breakdown of the weight given to each of the 10 categories:

The Most Business Friendly States

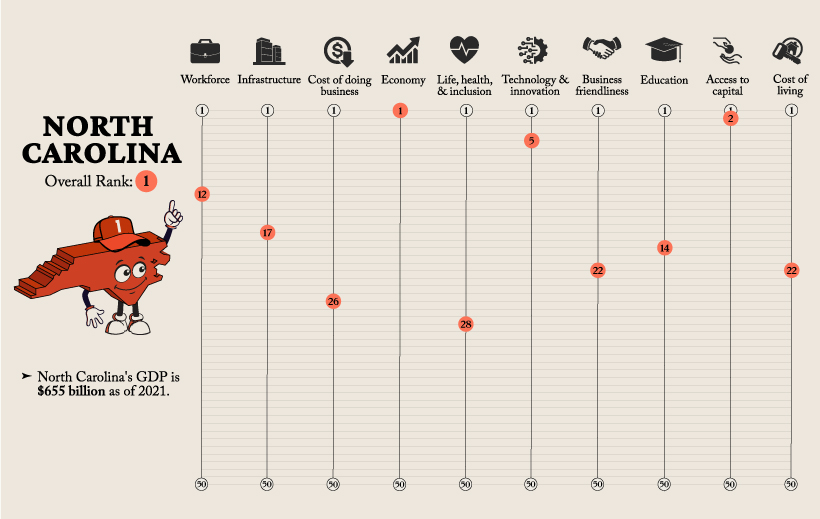

North Carolina—coming in first place in the ranking—attracts an extremely talented and innovative workforce, largely thanks to the state’s investment in its Research Triangle Regional Partnership (RTRP). Notably, there are three ties in the ranking: New York and South Carolina had the same score, tying for 36th, Connecticut and Nevada tied for 39th, and Hawaii and New Mexico tied for 46th. Other states ranking high on the list are Washington, Virginia, and Colorado. One of the newest individual metrics CNBC took into consideration was an openness to the cannabis industry, likely playing into Colorado’s move up from 8th to 4th compared to last year. Some states that perhaps surprisingly don’t crack the top 10 include California and New York, both often considered centers of finance and entrepreneurship. But with the high costs of living and of starting a business in those states, their overall score is reduced.

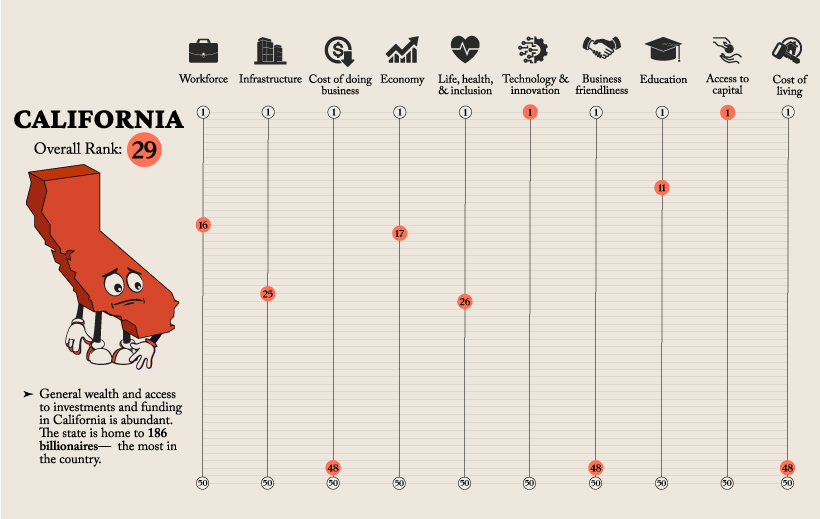

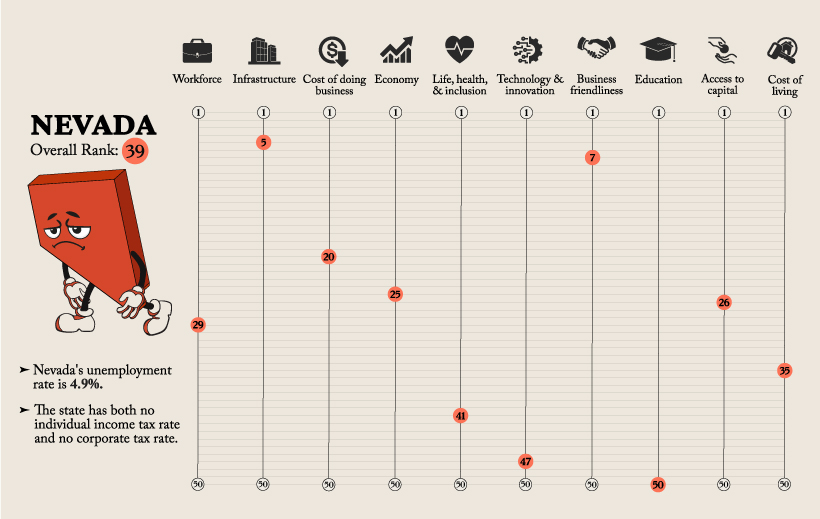

A Look at the Scoring — North Carolina, California, and Nevada

To better understand how this ranking works we’ve broken down three different states and how they ranked in all 10 categories that gave them their overall spot. Here’s a brief look at their place in each category:

While North Carolina is the number one state to do business in and has an extremely strong economy, they are 26th when it comes to the Cost of Doing Business.

Whereas California ranks low overall, the state ranks first in terms of Technology and Innovation, as well as Access to Capital.

Although Nevada scored highly in the Infrastructure and Business Friendliness categories, the state scored poorly in Technology and Innovation, and was dead last in the Education category.

Doing Business in America

New business applications have actually decreased 4% this year in comparison to the same timeframe in 2021. Here’s a look at new business applications by region as of July 2022:

Northeast: 63,058 Midwest: 70,827 South: 197,663 West: 94,150

New business applications in July were the highest in the retail trade industry, numbering around 69,000 new applications, according to the U.S. Census Bureau. Applications for professional service businesses were the second highest at 53,000, followed closely by construction businesses at 43,000. Here’s a closer look at the industry breakdown: A potential looming recession, alongside rising interest rates and inflation, may be creating a sense of cautiousness among businesspeople, leading to the lower rate of business applications compared to last year. And, at existing companies, the economic situation has lead to cuts in growth forecasts and subsequently, major layoffs. But overall, the U.S. is a country which values entrepreneurship—even during the pandemic, massive spikes in new business formations were recorded—and certain industries and states will continue to flourish in any business environment. on Both figures surpassed analyst expectations by a wide margin, and in January, the unemployment rate hit a 53-year low of 3.4%. With the recent release of February’s numbers, unemployment is now reported at a slightly higher 3.6%. A low unemployment rate is a classic sign of a strong economy. However, as this visualization shows, unemployment often reaches a cyclical low point right before a recession materializes.

Reasons for the Trend

In an interview regarding the January jobs data, U.S. Treasury Secretary Janet Yellen made a bold statement: While there’s nothing wrong with this assessment, the trend we’ve highlighted suggests that Yellen may need to backtrack in the near future. So why do recessions tend to begin after unemployment bottoms out?

The Economic Cycle

The economic cycle refers to the economy’s natural tendency to fluctuate between periods of growth and recession. This can be thought of similarly to the four seasons in a year. An economy expands (spring), reaches a peak (summer), begins to contract (fall), then hits a trough (winter). With this in mind, it’s reasonable to assume that a cyclical low in the unemployment rate (peak employment) is simply a sign that the economy has reached a high point.

Monetary Policy

During periods of low unemployment, employers may have a harder time finding workers. This forces them to offer higher wages, which can contribute to inflation. For context, consider the labor shortage that emerged following the COVID-19 pandemic. We can see that U.S. wage growth (represented by a three-month moving average) has climbed substantially, and has held above 6% since March 2022. The Federal Reserve, whose mandate is to ensure price stability, will take measures to prevent inflation from climbing too far. In practice, this involves raising interest rates, which makes borrowing more expensive and dampens economic activity. Companies are less likely to expand, reducing investment and cutting jobs. Consumers, on the other hand, reduce the amount of large purchases they make. Because of these reactions, some believe that aggressive rate hikes by the Fed can either cause a recession, or make them worse. This is supported by recent research, which found that since 1950, central banks have been unable to slow inflation without a recession occurring shortly after.

Politicians Clash With Economists

The Fed has raised interest rates at an unprecedented pace since March 2022 to combat high inflation. More recently, Fed Chairman Jerome Powell warned that interest rates could be raised even higher than originally expected if inflation continues above target. Senator Elizabeth Warren expressed concern that this would cost Americans their jobs, and ultimately, cause a recession. Powell remains committed to bringing down inflation, but with the recent failures of Silicon Valley Bank and Signature Bank, some analysts believe there could be a pause coming in interest rate hikes. Editor’s note: just after publication of this article, it was confirmed that U.S. interest rates were hiked by 25 basis points (bps) by the Federal Reserve.