It’s also a refrain that speaks the evolving demand picture for cannabis in a post-legalization environment, as it becomes clearer what products consumers want to see coming from the sector. Today’s infographic comes to us from The Green Organic Dutchman, and it dives deeper into the profound investor potential in cannabis retail products, like edibles and concentrates.

The Allure of Retail Products

As the business of cannabis matures, several trends are directing its course. Consumer spending in North America is ballooning overall, but growth largely depends on the product type.

While seasoned consumers prefer smoking cannabis, other consumers are actually drawn to alternative forms that the plant comes in. Proprietary research from New Frontier Data reveals the products that most appeal to potential U.S. cannabis consumers:

69% solid edibles 54% liquid edibles 44% topicals 36% joints or blunts 32% vaporizers (vapes) 29% tinctures 21% concentrates 19% pipes / water pipes

The rising popularity in retail cannabis-derived products is being directed by consumers – and they’re using products for everything from relaxation to pain management.

Variety is the Spice of Life

Food and beverages, along with wellness products, are proving to be a huge draw.

Food & Beverages

Most people are aware of pot brownies, even if they haven’t tried them. The best known cannabis edibles are baked goods, and these days they’re also found as candy and chocolate. Cannabis-infused drinks are also growing in popularity, in both alcoholic and non-alcoholic forms. Cannabis-infused water, juice, tea, coffee, and even kombucha are legally making their way onto grocery store shelves. Of course, before edibles can become fully mainstream, there are a few considerations: stricter regulations for product consistency, not to mention appropriate packaging and labeling to keep them away from children. As an example, Canada will start allowing edibles and other products in October 2019, as they iron out these kinks a year after full legalization.

Health & Wellness

Cannabis has been treasured for its medicinal and therapeutic properties for centuries. In the present, it has re-emerged in an intersection with the wellness industry. In fact, many consumers are already using CBD-infused products in their daily life:

Relieving anxiety Enhancing sleep Managing pain Personal care

Importantly, retail cannabis products are also helping consumers reduce their dependence on medications, and to kick unhealthy habits.

A Consumer-Driven Future

Consumers are not just eating cannabis up, but they are also drinking, vaping, dabbing — and the list goes on. For these reasons, investors should keep an eye on the fast-changing multitude of products and trends within the sector, as they provide some of the best opportunities going forward. In the final part of this series, we’ll dive into the role that the cannabidiol (CBD) compound plays in the cannabis market. on Humans have a storied and complicated relationship with drugs. Defined as chemical substances that cause a change in our physiology or psychology, many drugs are taken medicinally or accepted culturally, like caffeine, nicotine, and alcohol. But many drugs—including medicines and non-medicinal substances taken as drugs—are taken recreationally and can be abused. Each country and people have their own relationship to drugs, with some embracing the use of specific substances while others shun them outright. What are the most common drugs that are considered generally illicit in different parts of the world? Today’s graphics use data from the UN’s World Drug Report 2021 to highlight the most prevalent drug used in each country.

What Types of Common Drugs Are Tracked?

The World Drug Report looks explicitly at the supply and demand of the international illegal drug market, not including commonly legal substances like caffeine and alcohol. Drugs are grouped by class and type, with six main types of drugs found as the most prevalent drugs worldwide.

Cannabis*: Drugs derived from cannabis, including hemp. This category includes marijuana (dried flowers), hashish (resin), and other for various other parts of the plant or derived oils. Cocaine: Drugs derived from the leaves of coca plants. Labeled as either cocaine salts for powder form or crack for cocaine processed with baking soda and water into rock form. Opioids: Includes opiates which are derived directly from the opium poppy plant, including morphine, codeine, and heroin, as well as synthetic alkaloids. Amphetamine-type Stimulants (ATS): Amphetamine and drugs derived from amphetamine, including meth (also known as speed), MDMA, and ecstasy. Sedatives and Tranquilizers: Includes other drugs whose main purpose is to reduce energy, excitement, or anxiety, as well as drugs used primarily to initiate or help with sleep (also called hypnotics). Solvents and Inhalants: Gases or chemicals that can cause intoxication but are not intended to be drugs, including fuels, glues, and other industrial substances.

The report also tracked the prevalence of hallucinogens—psychoactive drugs which strongly affect the mind and cause a “trip”—but no hallucinogens ranked as the most prevalent drug in any one country. *Editor’s note: Recreational cannabis is legal in five countries, and some non-federal jurisdictions (i.e. states). However, in the context of this report, it was included because it is still widely illicit in most countries globally.

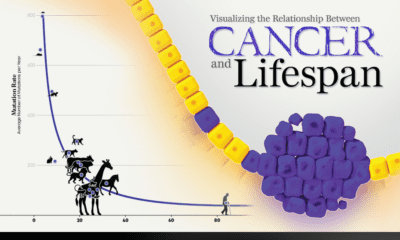

The Most Prevalent Drug in Each Country

According to the report, 275 million people used drugs worldwide in 2020. Between the ages of 15–64, around 5.5% of the global population used drugs at least once. Many countries grouped different types of the same drug class together, and a few like Saudi Arabia and North Macedonia had multiple different drug types listed as the most prevalent. But across the board, cannabis was the most commonly prevalent drug used in 107 listed countries and territories: How prevalent is cannabis worldwide? 72 locations or more than two-thirds of those reporting listed cannabis as the most prevalent drug. Unsurprisingly these include countries that have legalized recreational cannabis: Canada, Georgia, Mexico, South Africa, and Uruguay.

How Common Are Opioids and Other Drugs?

Though the global prevalence of cannabis is unsurprising, especially as it becomes legalized and accepted in more countries, other drugs also have strong footholds. Opioids (14 locations) were the most prevalent drugs in the Middle-East, South and Central Asia, including in India and Iran. Notably, Afghanistan is the world’s largest producer of opium, supplying more than 90% of illicit heroin globally. Amphetamine-type drugs (9 locations) were the third-most common drugs overall, mainly in East Asia. Methamphetamine was the reported most prevalent drug in China, South Korea, and Japan, while amphetamine was only the most common drug in Bangladesh. However, it’s important to note that illicit drug usage is tough to track. Asian countries where cannabis is less frequently found (or reported) might understate its usage. At the same time, the opioid epidemic in the U.S. and Canada reflects high opioid usage in the West. As some drugs become more widespread and others face a renewed “war,” the landscape is certain to shift over the next few years.