When you think of the iconic American brands of the 20th century, names like Coca-Cola and Pepsi have to rank pretty highly on any list. Both fizzy beverages became household names nearly 100 years ago and even butted heads in one of the most infamous and long-lasting marketing battles of all-time. In the process, both brands have sold billions of bottles of product, creating powerful foundations for their sprawling beverage empires of today. While the soda industry has seen incredible global growth over the years, it seems all good things must come to an end. Today’s slides on The Death of Soda come to us from Dynamic Wealth Research, and they show how new consumer preferences have left the soda industry flat, forcing its titans to scramble to recapture market share. We also see what is replacing sugary beverages, and the market potential behind some of these new segments.

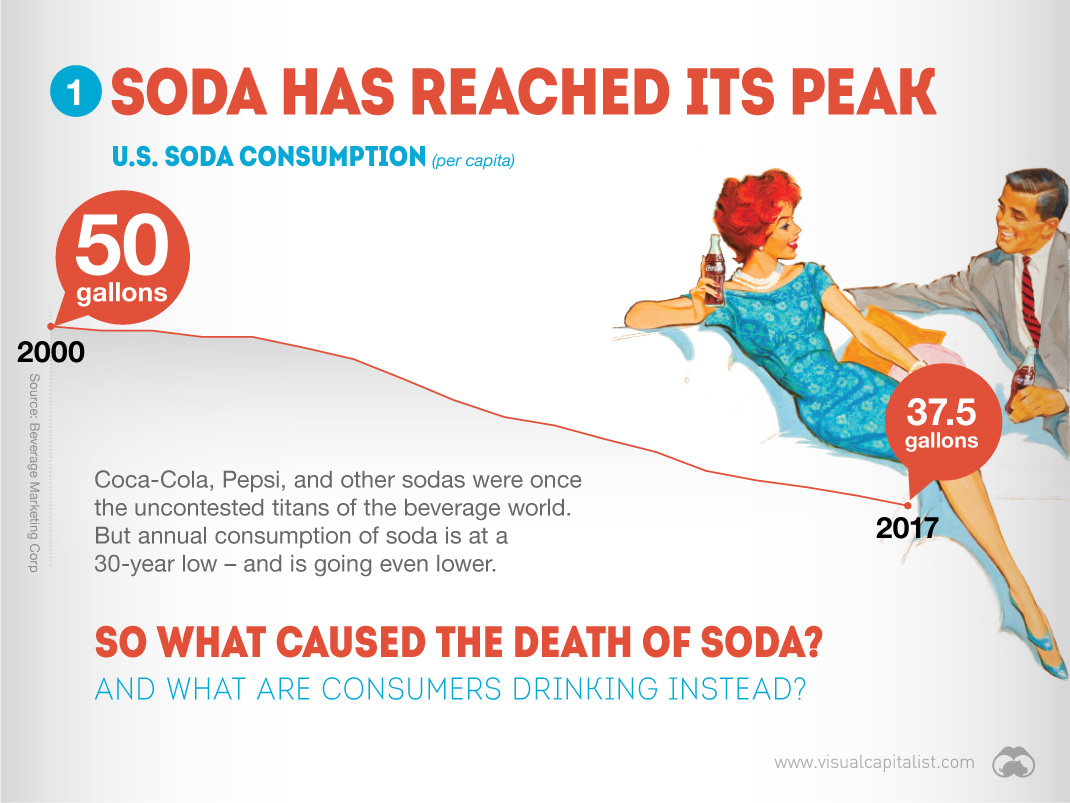

1. U.S. Soda Consumption is at a 30-year low

Soda consumption in the U.S. has dropped from 50 gallons to 37.5 gallons per capita between 2000 and 2017. It’s now at a 30-year low.

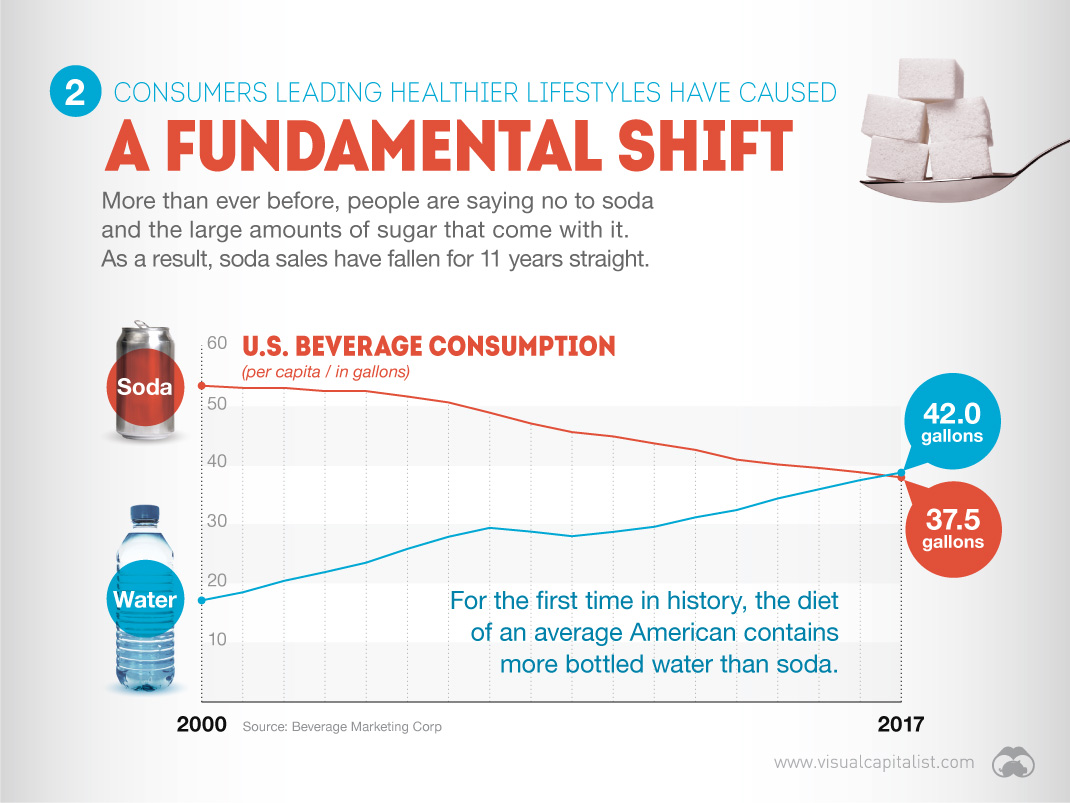

2. Bottled water is taking over

For the first time in U.S. history, more bottled water is being sold than soda per person. It’s a fundamental shift in consumer habits – if you look at the graph, you can see that as recent as the mid-2000s, people drank twice as much soda per capita.

3. Calorie consumption is changing

Most of us are eating differently these days, but these changes are extremely evident when looking at calorie consumption of children. As you can see, sugar sweetened drinks are falling off the map in a big way.

4. People are drinking water, instead

What’s getting substituted for sugar sweetened drinks? Water is a big one: it’s healthy, convenient, and natural – all things that appeal to today’s health-conscious consumers.

5. The water market is maturing

As the market matures, different segments an niches are being carved out. For example, water can be plain, sparkling, enhanced, or premium.

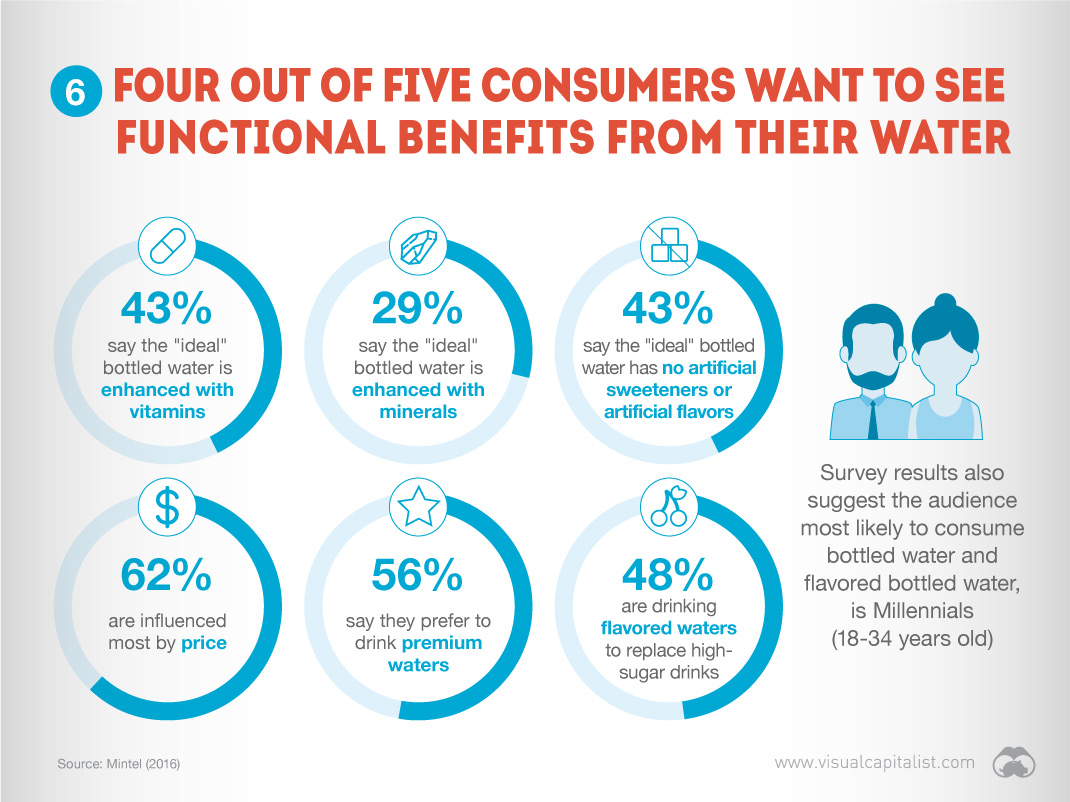

6. Consumers want more than plain water

Plain water can also be poured from a tap, so it’s not surprising that consumers want to see their water enhanced in some way. Many are also sensitive to price.

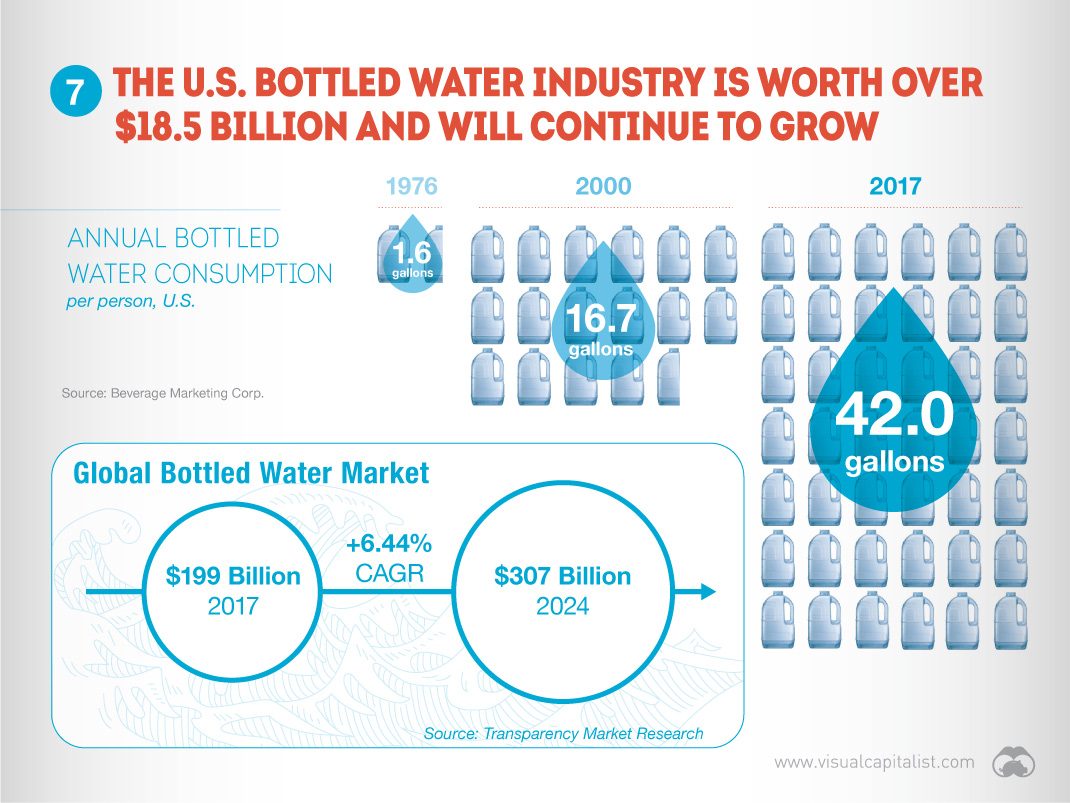

7. The bottled water market is worth billions

In 2017, the global bottled water market was worth $199 billion.

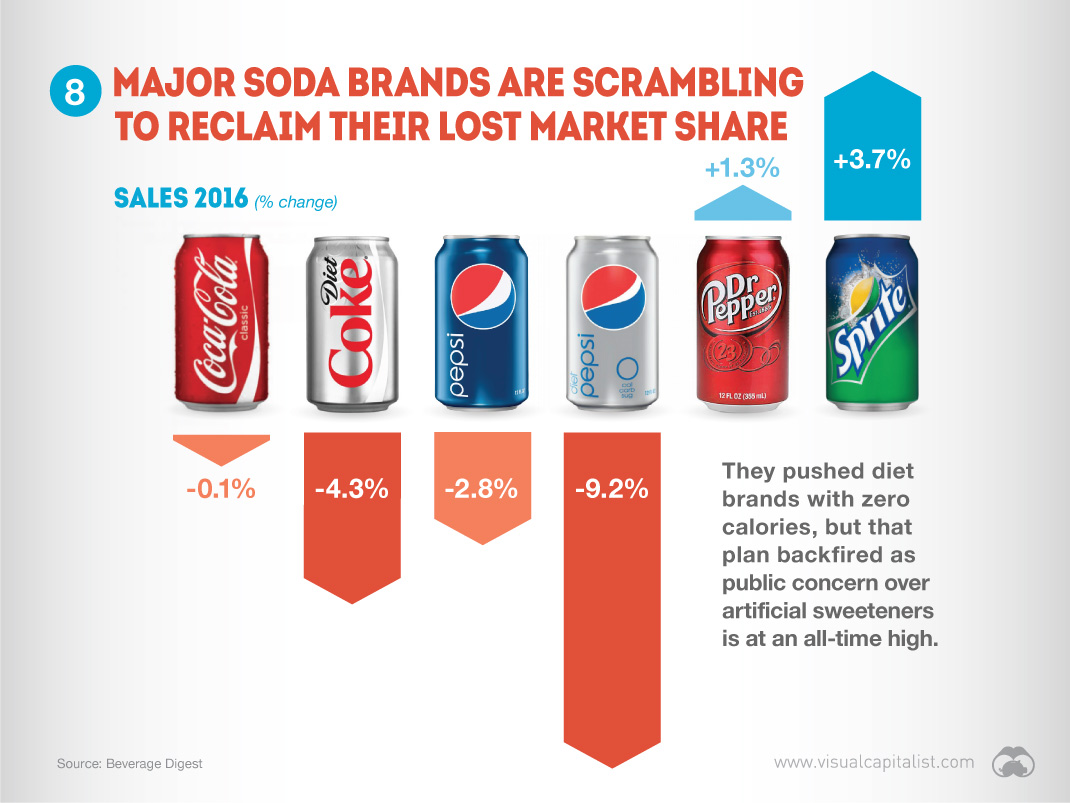

8. Soda brands are scrambling

Soda brands pushed their diet products, but this backfired as consumers became concerned about the impact of artificial sweeteners on their diets.

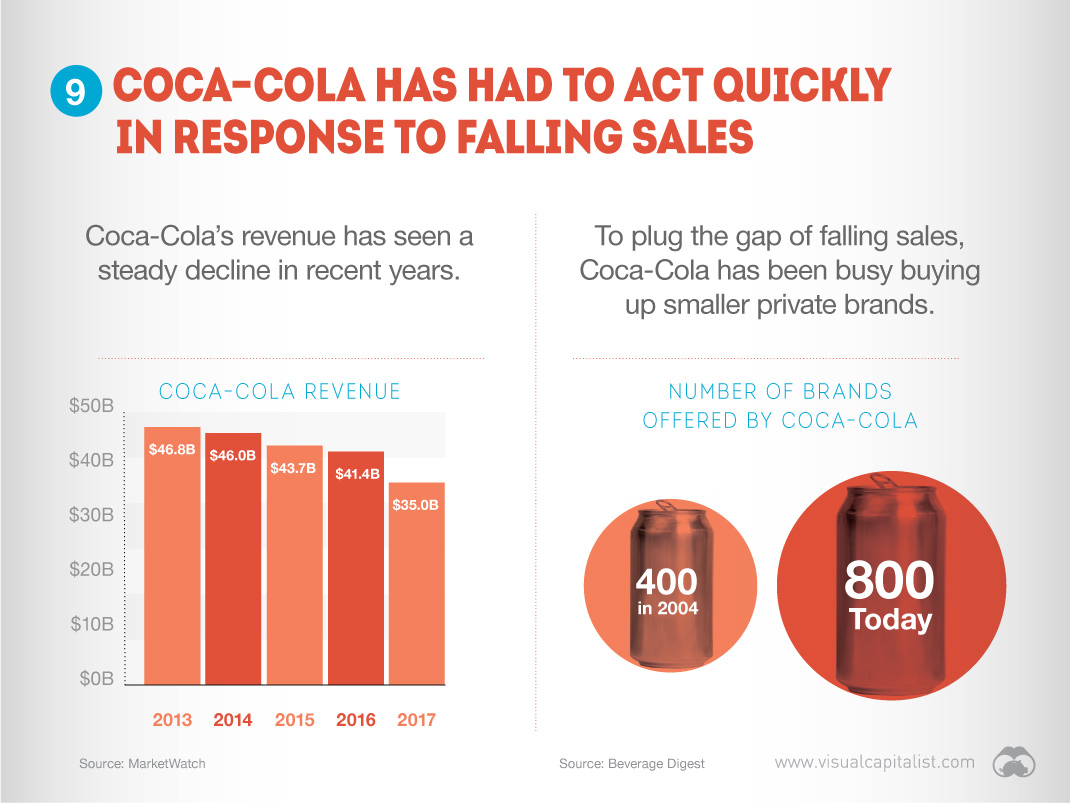

9. Coca-Cola is diversifying its business

In response to the death of soda, companies like Coca-Cola are adding brands to their portfolio that can compete in less traditional segments. Examples of these brands include everything from energy drinks to coconut water.

10. Big brands are buying up smaller companies

Big fish like Coca-Cola and PepsiCo are gobbling up innovative beverage startups in order to compete in these new and emerging segments.

11. The trend is your friend

As the beverage industry continues to get turned upside down by the death of soda, it creates opportunities for savvy investors. The global bottled water market will reach an impressive $307 billion by 2021, and new segments will continue to emerge as consumers become even more health-conscious.

on The good news is that the Federal Reserve, U.S. Treasury, and Federal Deposit Insurance Corporation are taking action to restore confidence and take the appropriate measures to help provide stability in the market. With this in mind, the above infographic from New York Life Investments looks at the factors that impact bonds, how different types of bonds have historically performed across market environments, and the current bond market volatility in a broader context.

Bond Market Returns

Bonds had a historic year in 2022, posting one of the worst returns ever recorded. As interest rates rose at the fastest pace in 40 years, it pushed bond prices lower due to their inverse relationship. In a rare year, bonds dropped 13%.

Source: FactSet, 01/02/2023.

Bond prices are only one part of a bond’s total return—the other looks at the income a bond provides. As interest rates have increased in the last year, it has driven higher bond yields in 2023.

Source: YCharts, 3/20/2023.

With this recent performance in mind, let’s look at some other key factors that impact the bond market.

Factors Impacting Bond Markets

Interest rates play a central role in bond market dynamics. This is because they affect a bond’s price. When rates are rising, existing bonds with lower rates are less valuable and prices decline. When rates are dropping, existing bonds with higher rates are more valuable and their prices rise. In March, the Federal Reserve raised rates 25 basis points to fall within the 4.75%-5.00% range, a level not seen since September 2007. Here are projections for where the federal funds rate is headed in 2023:

Federal Reserve Projection*: 5.1% Economist Projections**: 5.3%

*Based on median estimates in the March summary of quarterly economic projections.**Projections based on March 10-15 Bloomberg economist survey. Together, interest rates and the macroenvironment can have a positive or negative effect on bonds.

Positive

Here are three variables that may affect bond prices in a positive direction:

Lower Inflation: Reduces likelihood of interest rate hikes. Lower Interest Rates: When rates are falling, bond prices are typically higher. Recession: Can prompt a cut in interest rates, boosting bond prices.

Negative

On the other hand, here are variables that may negatively impact bond prices:

Higher Inflation: Can increase the likelihood of the Federal Reserve to raise interest rates. Rising Interest Rates: Interest rate hikes lead bond prices to fall. Weaker Fundamentals: When a bond’s credit risk gets worse, its price can drop. Credit risk indicates the chance of a default, the risk of a bond issuer not making interest payments within a given time period.

Bonds have been impacted by these negative factors since inflation started rising in March 2021.

Fixed Income Opportunities

Below, we show the types of bonds that have had the best performance during rising rates and recessions.

Source: Derek Horstmeyer, George Mason University 12/3/2022. As we can see, U.S. ultrashort bonds performed the best during rising rates. Mortgage bonds outperformed during recessions, averaging 11.4% returns, but with higher volatility. U.S. long-term bonds had 7.7% average returns, the best across all market conditions. In fact, they were also a close second during recessions. When rates are rising, ultrashort bonds allow investors to capture higher rates when they mature, often with lower historical volatility.

A Closer Look at Bond Market Volatility

While bond market volatility has jumped this year, current dislocations may provide investment opportunities. Bond dislocations allow investors to buy at lower prices, factoring in that the fundamental quality of the bond remains strong. With this in mind, here are two areas of the bond market that may provide opportunities for investors:

Investment-Grade Corporate Bonds: Higher credit quality makes them potentially less vulnerable to increasing interest rates. Intermediate Bonds (2-10 Years): Allow investors to lock in higher rates.

Both types of bonds focus on quality and capturing higher yields when faced with challenging market conditions.

Finding the Upside

Much of the volatility seen in the banking sector was due to banks buying bonds during the pandemic—or even earlier—at a time when interest rates were historically low. Since then, rates have climbed considerably. Should rates moderate or stop increasing, this may present better market conditions for bonds. In this way, today’s steep discount in bond markets may present an attractive opportunity for price appreciation. At the same time, investors can potentially lock in strong yields as inflation may subside in the coming years ahead. Learn more about bond investing strategies with New York Life Investments.