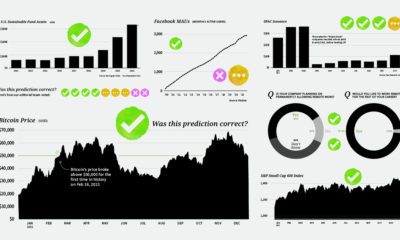

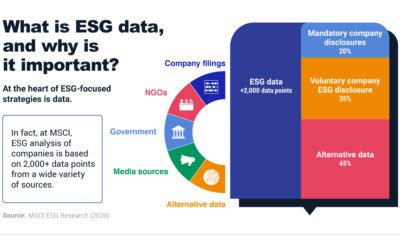

Between January and November 2020 alone, investments in sustainable ETF and mutual funds grew 96%. The UN Principles of Responsible Investment now has over 3,000 signatories representing over $100 trillion in assets. The U.S. Commodity Futures Trading Commission established a Climate Risk Unit to analyze climate risk across derivative markets, and as of March 2021, new sustainability disclosures have come into effect in Europe. But how do we know if sustainable investments have made a difference? To answer this question, the above infographic from MSCI examines the effect of a sustainable investment dollar by looking at real-world examples.

A Sustainable vs. Unsustainable Dollar

To start, investing legend Benjamin Graham has compared the stock market to a “voting machine.” Just as consumers vote with their purchasing decisions, investors vote with their investment dollars. Especially in the short term, as more dollars flow to sustainable companies, this builds their exposure and access to capital. In the long term, meanwhile, the market can be compared to a weighing machine. The market recognizes companies with profitable business models that improve their intrinsic value over time. Ultimately, this allows sustainable companies to expand and continue operating. Given the rising momentum in both green assets and climate targets, here is how investment dollars have influenced and driven change across three industries.

1. Clean Energy vs. Fossil Fuel

Over the last several years, the energy sector has been associated with many of the problems causing climate change. For this reason, many investors are seeking out greener energy alternatives. But how does moving investment dollars from an ESG laggard to an ESG leader support the environment and society? First, here is a brief explainer of ESG laggards and leaders:

ESG laggards: companies with the weakest environmental, social, and governance (ESG) performance in their sector. ESG leaders: companies with the strongest environmental, social, and governance (ESG) performance in their sector.

Source: MSCI ESG Research Based on the above example, investors have the ability to finance powerful green initiatives that reduce emissions by almost half, relative to their peers.

2. Safe vs. Unsafe Working Conditions

Weak safety protocols are a key sustainability issue for the industrial sector. Here’s how two companies compare:

Source: MSCI ESG Research

Despite the risks involved in the sector, investors can choose to support companies that take greater precautions to protect their workers.

3. Building Trust vs. Losing Trust

Over the last several years, the financial sector has faced increased scrutiny over fraudulent activities. Moving investment dollars from an ESG laggard to ESG leader may make a difference:

Source: MSCI ESG Research

From board diversity to green loans, a sustainable investment dollar supports companies that are actively advancing society and the environment.

Sustainable Investment: The Time to Act

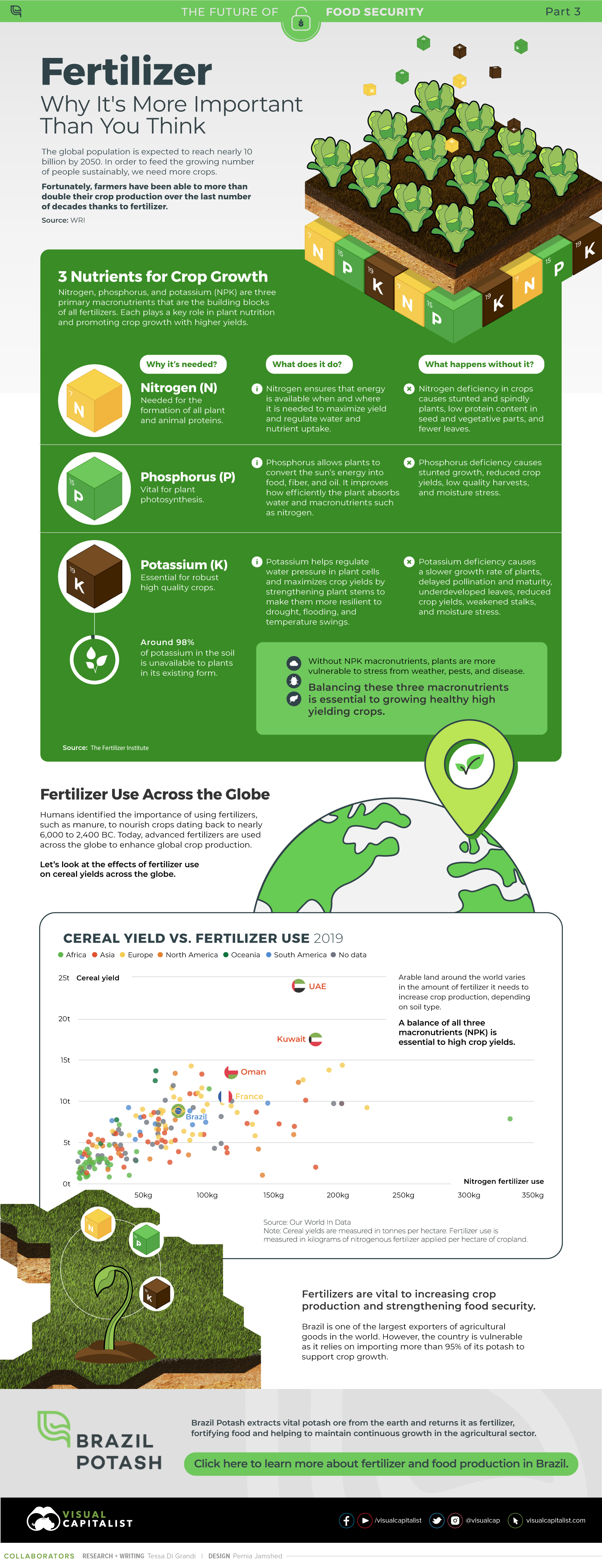

Recently, investor dollars and shareholder activism have been closely linked. Between 2018 and 2020, large institutional investors filed 217 shareholder proposals on climate change alone, putting increased pressure on companies. Meanwhile, 270 proposals were filed on corporate political activity and 228 on fair labor and equal employment opportunity over the same timeframe. Across all ESG proposals, $2 trillion in assets were pushing for more equitable corporate action. Through the power of a dollar, investors can send a clear signal to companies: the time for sustainable investing is now. on Over recent decades, farmers have been able to more than double their production of crops thanks to fertilizers and the vital nutrients they contain. When crops are harvested, the essential nutrients are taken away with them to the dining table, resulting in the depletion of these nutrients in the soil. To replenish these nutrients, fertilizers are needed, and the cycle continues. The above infographic by Brazil Potash shows the role that each macronutrient plays in growing healthy, high-yielding crops.

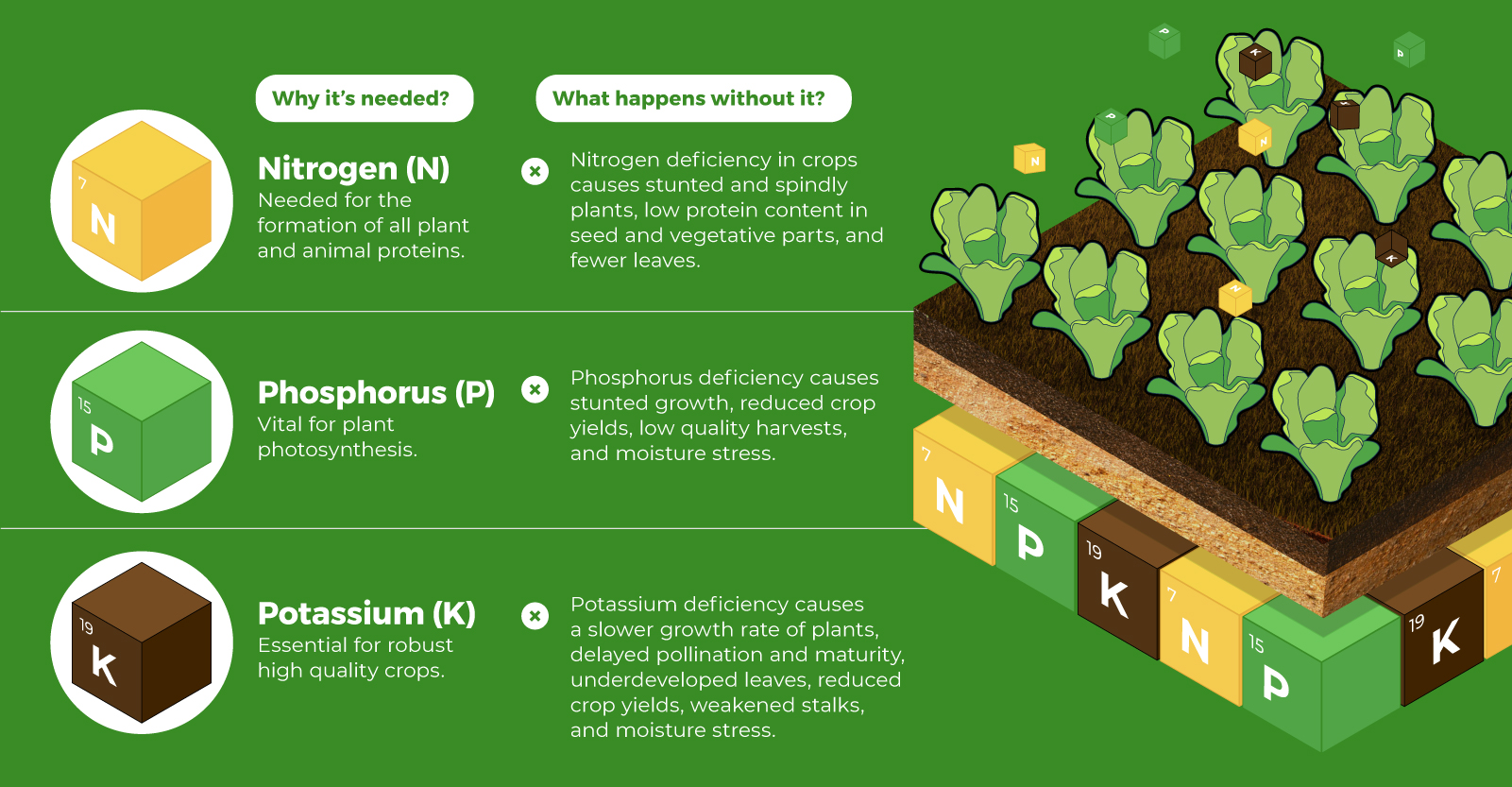

Food for Growth

Nitrogen, phosphorus, and potassium (NPK) are three primary macronutrients that are the building blocks of the global fertilizer industry. Each plays a key role in plant nutrition and promoting crop growth with higher yields. Let’s take a look at how each macronutrient affects plant growth. If crops lack NPK macronutrients, they become vulnerable to various stresses caused by weather conditions, pests, and diseases. Therefore, it is crucial to maintain a balance of all three macronutrients for the production of healthy, high-yielding crops.

The Importance of Fertilizers

Humans identified the importance of using fertilizers, such as manure, to nourish crops dating back to nearly 6,000 to 2,400 BC. As agriculture became more intensive and large-scale, farmers began to experiment with different types of fertilizers. Today advanced chemical fertilizers are used across the globe to enhance global crop production. There are a myriad of factors that affect soil type, and so the farmable land must have a healthy balance of all three macronutrients to support high-yielding, healthy crops. Consequently, arable land around the world varies in the amount and type of fertilizer it needs. Fertilizers play an integral role in strengthening food security, and a supply of locally available fertilizer is needed in supporting global food systems in an ever-growing world. Brazil is one of the largest exporters of agricultural goods in the world. However, the country is vulnerable as it relies on importing more than 95% of its potash to support crop growth. Brazil Potash is developing a new potash project in Brazil to ensure a stable domestic source of this nutrient-rich fertilizer critical for global food security. Click here to learn more about fertilizer and food production in Brazil.