With a wide range of global sustainability challenges and complex risks on the rise, investors are starting to re-evaluate traditional portfolio approaches.

The ESG Boom

Today, many investors want their money to align with a higher purpose beyond profit. This infographic from iShares unpacks the prolific rise of sustainable investing, and how its trillion-dollar potential is sweeping across the world.

What is Sustainable Investing?

Sustainable investing considers environmental, social, and governance (ESG) factors that create a lasting, positive impact on the world. As the term ‘ESG’ suggests, its scope goes well beyond environmental concerns alone. Examples include:

Environmental: Climate risks, resource scarcity, and clean energy Social: Diversity, human rights, and cybersecurity Governance: Business ethics, transparency, and anti-corruption

Simply put, it’s a force for good. Although sustainable investing emerged in the 1970s, the movement has gained impressive traction in the last few years.

How Global Assets are Growing

Since 2012, total assets in sustainable investing have more than doubled:

The European ESG Landscape

Across major economies in Europe, cultural shifts and new regulations are shaping the landscape of sustainable investing.

The UK has an ambitious net-zero greenhouse gas emissions target by 2050. Result: Most sectors will significantly ramp up their decarbonisation efforts to meet this goal. As per France’s Article 173 (Energy Transition Law), investors must explain how they incorporate ESG factors into their investment strategies. Result: A majority of French institutional investors now manage their assets with ESG criteria in mind. Nordic countries consider sustainability and social responsibility a cornerstone of their cultural mindset. Result: Nordic investors are increasingly integrating all three ESG aspects into their investments.

If Europe’s trajectory is any indication, sustainable investing will soon become second nature in other parts of the world too.

No Industry is Untouched

The rise of sustainable investing is a global phenomenon, and reaches a myriad of industries. Here is a summary of just a few ESG efforts of some of the world’s most sustainable corporations:

How Can Investors Think Sustainably?

Many investment products allow investors to easily access sustainable investing, such as exchange-traded funds (ETFs) and index funds. These provide complete transparency—allowing investors to align their approach with the objectives that matter most to them. Investors are able to: Not only this, but sustainable investing also has the potential to improve portfolio returns. In a 2015 paper covering ESG investing since the 1970s, 90% of ESG investing matched or overperformed traditional approaches.

The Bottom Line

Investors see a triple bottom line from sustainable investing: strong financial returns, and a lasting impact on both people and the planet.

As sustainable investing goes mainstream, it won’t simply act as a niche in a broader strategy—instead, it’ll be naturally integrated throughout a portfolio.

—Larry Fink, BlackRock Chairman and CEO

Sustainability is a global force that will continue to factor into everyday decisions.

Soon, sustainable investing will simply be considered “investing”.

on

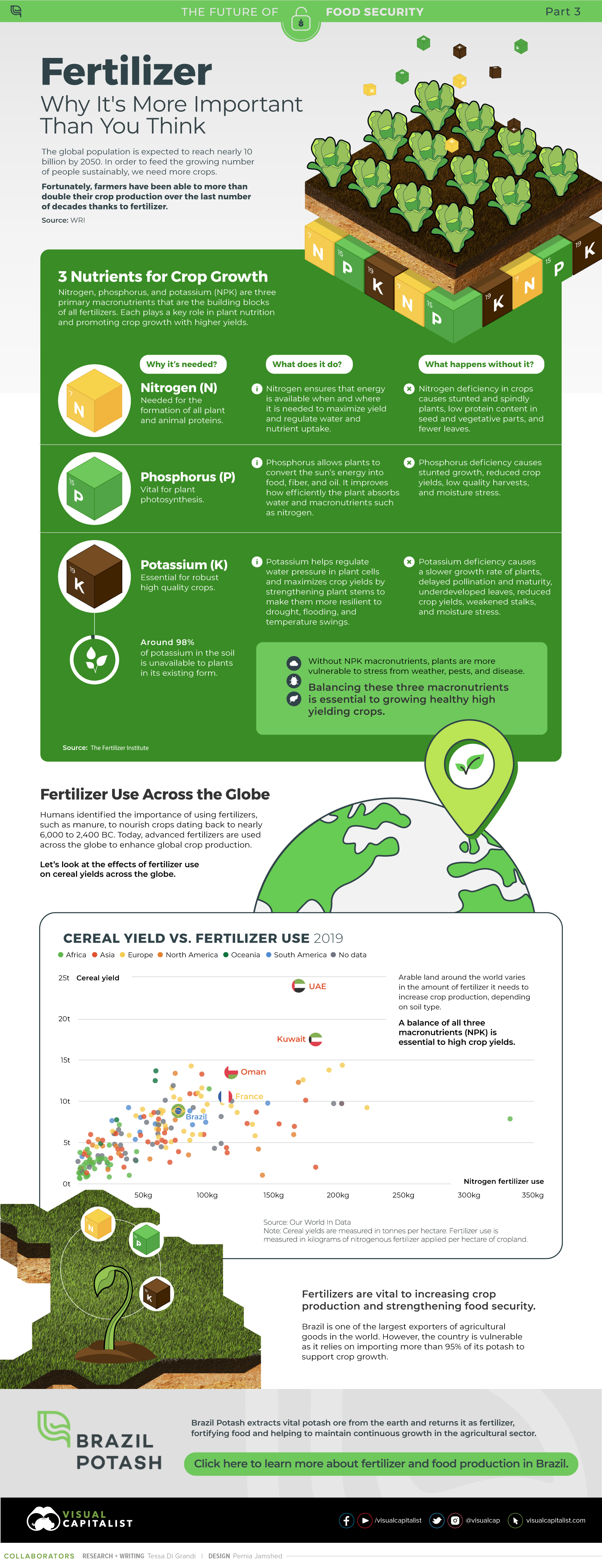

Over recent decades, farmers have been able to more than double their production of crops thanks to fertilizers and the vital nutrients they contain.

When crops are harvested, the essential nutrients are taken away with them to the dining table, resulting in the depletion of these nutrients in the soil. To replenish these nutrients, fertilizers are needed, and the cycle continues.

The above infographic by Brazil Potash shows the role that each macronutrient plays in growing healthy, high-yielding crops.

Food for Growth

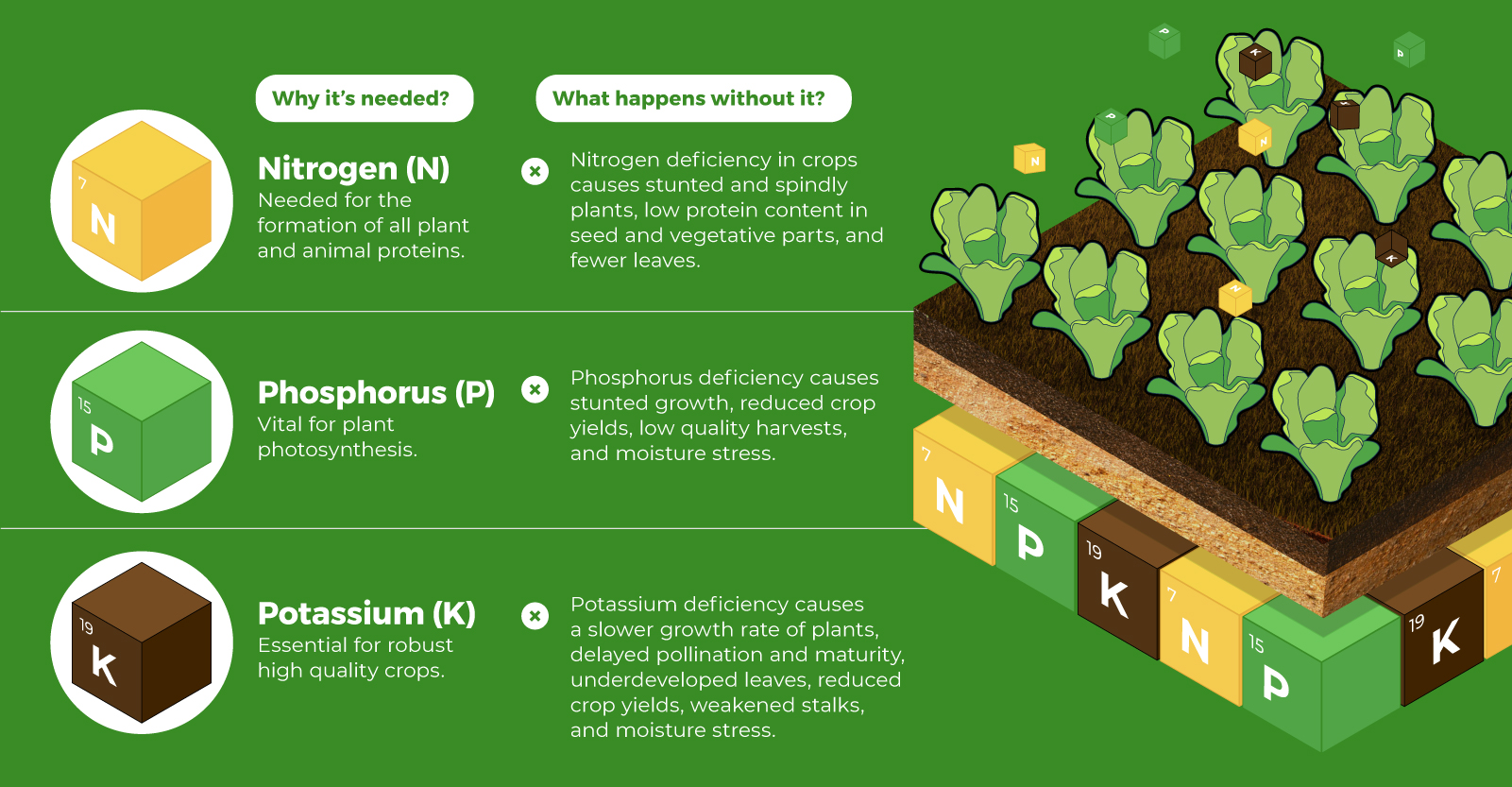

Nitrogen, phosphorus, and potassium (NPK) are three primary macronutrients that are the building blocks of the global fertilizer industry. Each plays a key role in plant nutrition and promoting crop growth with higher yields. Let’s take a look at how each macronutrient affects plant growth. If crops lack NPK macronutrients, they become vulnerable to various stresses caused by weather conditions, pests, and diseases. Therefore, it is crucial to maintain a balance of all three macronutrients for the production of healthy, high-yielding crops.

The Importance of Fertilizers

Humans identified the importance of using fertilizers, such as manure, to nourish crops dating back to nearly 6,000 to 2,400 BC. As agriculture became more intensive and large-scale, farmers began to experiment with different types of fertilizers. Today advanced chemical fertilizers are used across the globe to enhance global crop production. There are a myriad of factors that affect soil type, and so the farmable land must have a healthy balance of all three macronutrients to support high-yielding, healthy crops. Consequently, arable land around the world varies in the amount and type of fertilizer it needs. Fertilizers play an integral role in strengthening food security, and a supply of locally available fertilizer is needed in supporting global food systems in an ever-growing world. Brazil is one of the largest exporters of agricultural goods in the world. However, the country is vulnerable as it relies on importing more than 95% of its potash to support crop growth. Brazil Potash is developing a new potash project in Brazil to ensure a stable domestic source of this nutrient-rich fertilizer critical for global food security. Click here to learn more about fertilizer and food production in Brazil.