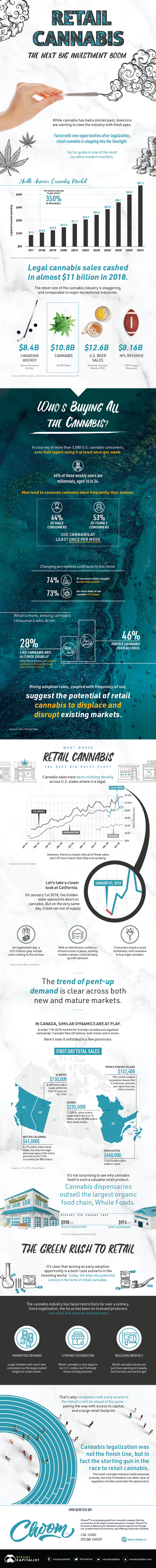

Chances to be an early adopter in the next billion-dollar industry are far and few in between – but it’s exactly what is happening today with the nascent cannabis market. After close to a century of prohibition, cannabis is back in the limelight as legalization rolls across the U.S. and Canada.

Visualizing the Retail Boom

Today’s infographic from Choom Holdings Inc demonstrates the consumer interest in retail cannabis, and the challenges and opportunities that come with this potential.

Legal cannabis today is a lucrative modern market in the U.S. and Canada. In 2018, sales were $10.8 billion – and they are expected to grow to $47.3 billion by 2027. Who’s driving this growth? A recent survey reveals that:

58% of U.S. cannabis consumers use it at least once a week 66% of these weekly users are millennials, aged 18 to 34 46% of cannabis consumers who also drink, prefer it over alcohol 74% of cannabis consumers who also drink, believe it to be safer than alcohol

With more people using cannabis frequently, the disruptive potential of retail cannabis becomes clear.

The Cannabis Supply Issue

Colorado, Washington, Nevada, and most recently California have been among the major U.S. states to legalize recreational cannabis in recent years. Although cannabis sales across all states have soared, there’s one caveat to mention, which is clearly seen in the case of California. As the state began selling cannabis in stores on January 1st, it also simultaneously ran out of supply when the grey market came rushing up. This trend of pent-up demand is clear across both mature and new markets – even Canada couldn’t escape the same supply crunch, subjecting customers to long lines and wait times on day one of legalization. For example, only one legal retail store was open in the entire province of British Columbia on October 17th. It’s not surprising to see why cannabis is such a valuable retail product, though: dispensaries typically outsell Whole Foods and other similar retailers. [table “405” not found /] (Source: Marijuana Business Daily)

The Value Play in Cannabis

Seizing an early adoption opportunity is a best-case scenario in the investing world. Today, such an opportunity may come in the form of retail cannabis. The segment still faces specific hurdles, but these challenges have the potential to convert into golden opportunities as the market matures in North America:

- Inherited demand Legal retailers will reach new consumers as the grey market begins to come online.

- Strong foundation Retail cannabis is only legal in ten U.S. states, but it already shows strong promise.

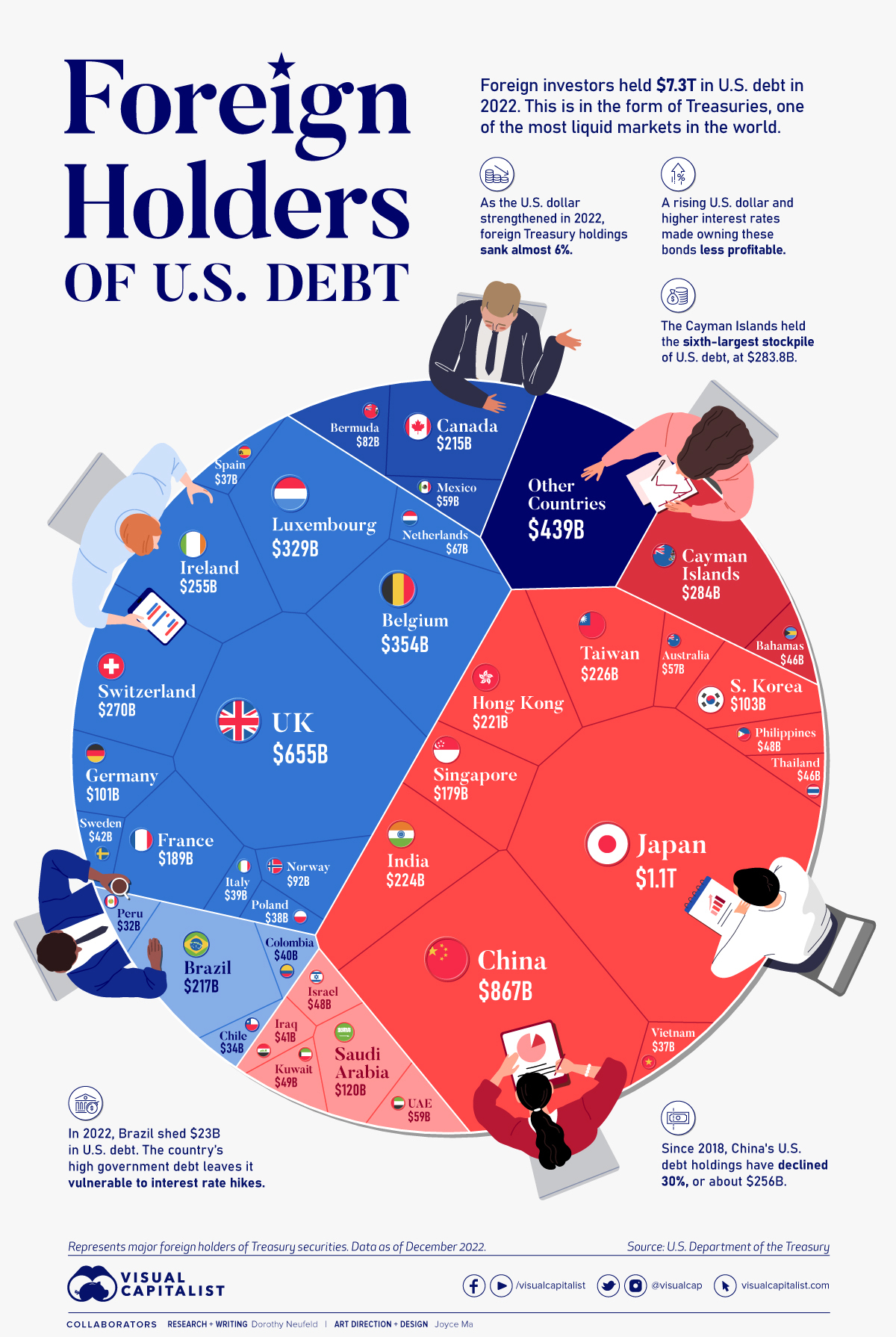

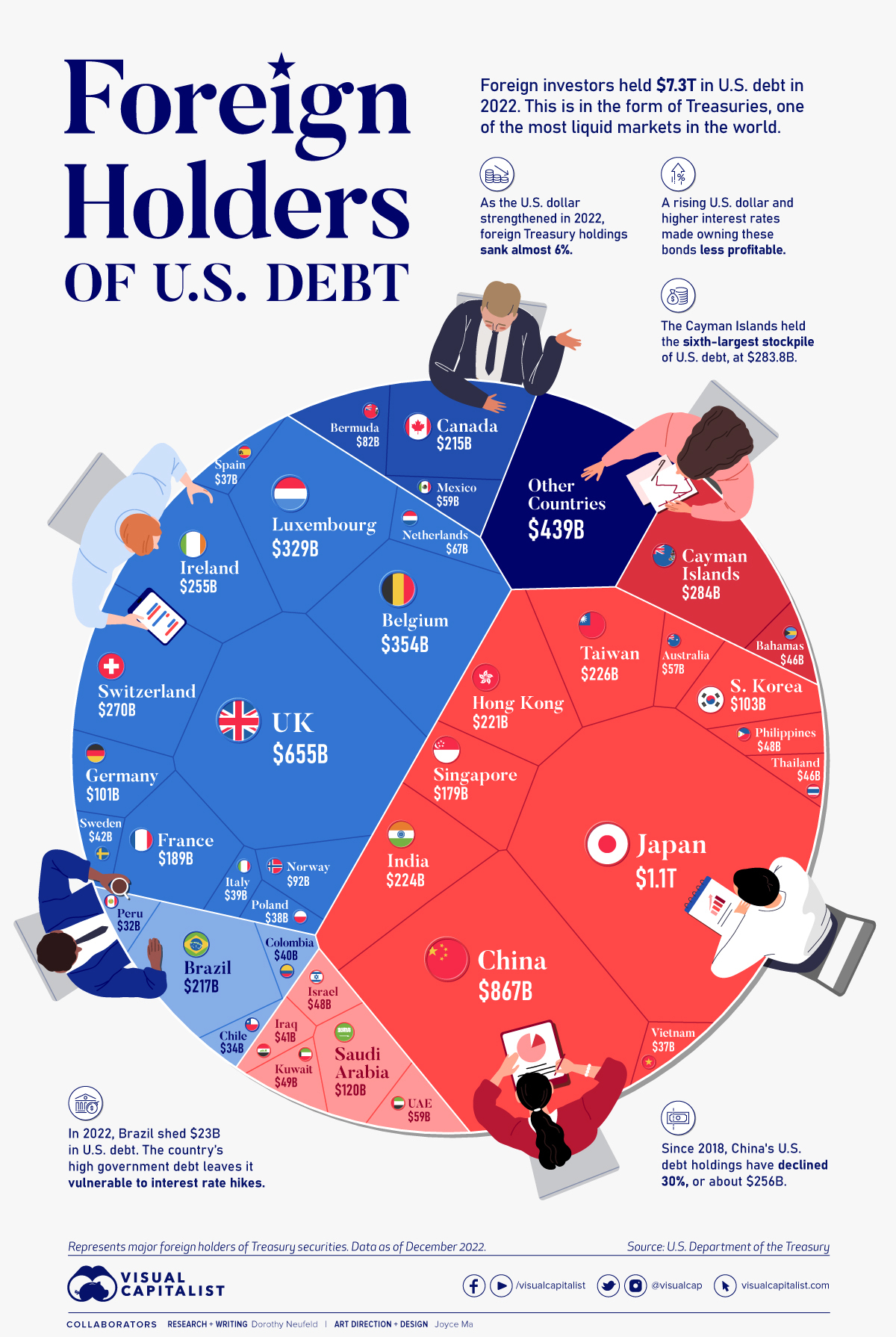

- Building bridges Retail cannabis stores are just now opening in Canada, but licenses are hard to get. Retail cannabis is a brave new world for consumers and investors alike – and early entrants to the industry with access to capital and a large retail footprint will likely lead the charge. on These are in the form of Treasury securities, some of the most liquid assets worldwide. Central banks use them for foreign exchange reserves and private investors flock to them during flights to safety thanks to their perceived low default risk. Beyond these reasons, foreign investors may buy Treasuries as a store of value. They are often used as collateral during certain international trade transactions, or countries can use them to help manage exchange rate policy. For example, countries may buy Treasuries to protect their currency’s exchange rate from speculation. In the above graphic, we show the foreign holders of the U.S. national debt using data from the U.S. Department of the Treasury.

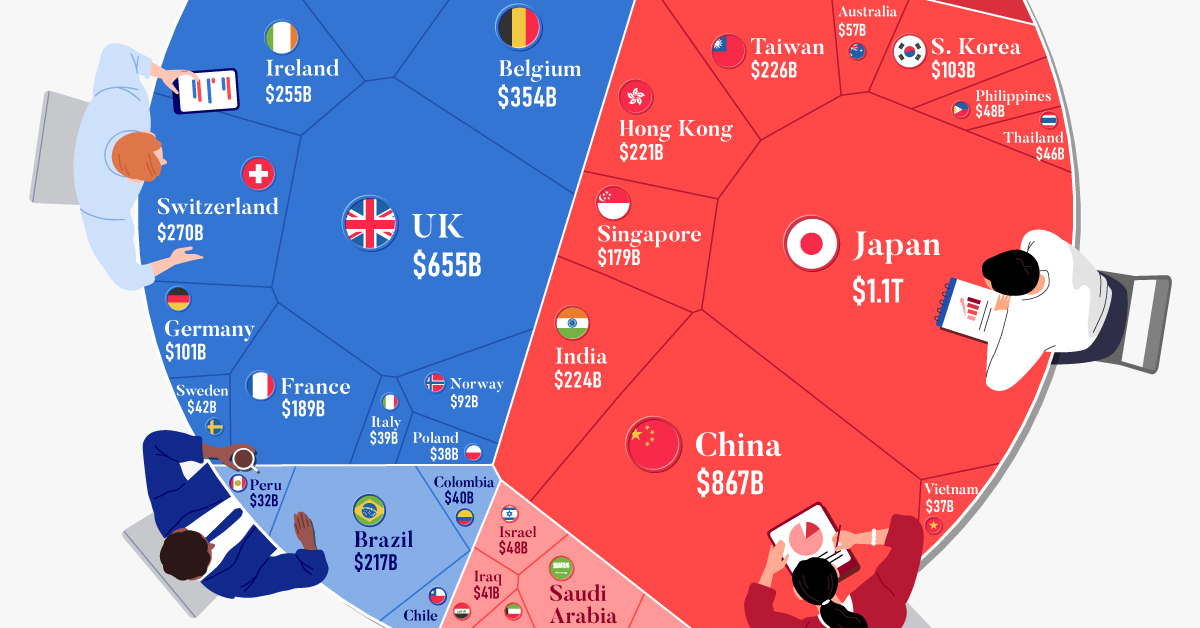

Top Foreign Holders of U.S. Debt

With $1.1 trillion in Treasury holdings, Japan is the largest foreign holder of U.S. debt. Japan surpassed China as the top holder in 2019 as China shed over $250 billion, or 30% of its holdings in four years. This bond offloading by China is the one way the country can manage the yuan’s exchange rate. This is because if it sells dollars, it can buy the yuan when the currency falls. At the same time, China doesn’t solely use the dollar to manage its currency—it now uses a basket of currencies. Here are the countries that hold the most U.S. debt: As the above table shows, the United Kingdom is the third highest holder, at over $655 billion in Treasuries. Across Europe, 13 countries are notable holders of these securities, the highest in any region, followed by Asia-Pacific at 11 different holders. A handful of small nations own a surprising amount of U.S. debt. With a population of 70,000, the Cayman Islands own a towering amount of Treasury bonds to the tune of $284 billion. There are more hedge funds domiciled in the Cayman Islands per capita than any other nation worldwide. In fact, the four smallest nations in the visualization above—Cayman Islands, Bermuda, Bahamas, and Luxembourg—have a combined population of just 1.2 million people, but own a staggering $741 billion in Treasuries.

Interest Rates and Treasury Market Dynamics

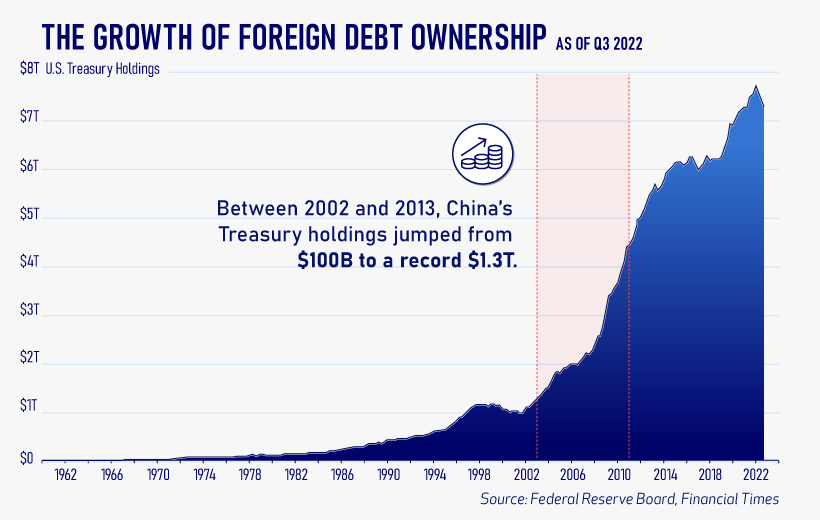

Over 2022, foreign demand for Treasuries sank 6% as higher interest rates and a strong U.S. dollar made owning these bonds less profitable. This is because rising interest rates on U.S. debt makes the present value of their future income payments lower. Meanwhile, their prices also fall. As the chart below shows, this drop in demand is a sharp reversal from 2018-2020, when demand jumped as interest rates hovered at historic lows. A similar trend took place in the decade after the 2008-09 financial crisis when U.S. debt holdings effectively tripled from $2 to $6 trillion.

Driving this trend was China’s rapid purchase of Treasuries, which ballooned from $100 billion in 2002 to a peak of $1.3 trillion in 2013. As the country’s exports and output expanded, it sold yuan and bought dollars to help alleviate exchange rate pressure on its currency. Fast-forward to today, and global interest-rate uncertainty—which in turn can impact national currency valuations and therefore demand for Treasuries—continues to be a factor impacting the future direction of foreign U.S. debt holdings.